E-Commerce & Virtual Payment Solutions

As more consumers turn to digital platforms for their shopping needs, your business needs reliable, secure, and user-friendly e-commerce and virtual payment solutions to stay competitive. At Good Payments Merchant Services, we help businesses like yours expand their online presence, improve checkout experiences, and process payments securely—anytime, anywhere.

Whether you’re launching an online store or upgrading your current platform, our e-commerce solutions are designed to support your growth and provide a seamless experience for your customers.

Let's Get Started

Not sure where to start? Call us and our merchant services experts will guide you to the perfect solution that meets your needs.

What Is E-Commerce?

E-commerce refers to the buying and selling of goods and services over the internet. From physical products to digital content and service subscriptions, e-commerce enables businesses to connect with a global audience and operate 24/7.

Key benefits include:

- Increased customer convenience and accessibility

- Lower operational costs compared to brick-and-mortar setups

- Real-time payment processing and reporting

- Scalable growth potential

At Good Payments Merchant Services, we ensure your e-commerce setup includes secure payment gateways, easy integration, and fraud prevention tools, helping you build trust and boost sales.

Why Understanding E-Commerce Matters

A successful online business requires more than just a website—it demands a comprehensive understanding of e-commerce models, payment flows, and customer expectations. Our team helps you navigate this landscape by:

- Identifying the best payment solutions for your products or services

- Ensuring your platform supports major payment types (credit, debit, digital wallets)

- Offering tools to streamline the checkout experience and reduce cart abandonment

By partnering with Good Payments Merchant Services, you can confidently create a secure, flexible, and customer-friendly e-commerce environment tailored to your specific goals.

Types of E-Commerce Models

Understanding the various e-commerce models is essential for selecting the right approach to grow your online business. At Good Payments Merchant Services, we support all major e-commerce frameworks, enabling you to tailor your operations to match your audience and industry.

Below are the most common e-commerce models:

|

Model |

Description |

|

B2B |

Business-to-Business: Companies selling to other businesses |

|

B2C |

Business-to-Consumer: Businesses selling directly to end consumers |

|

C2C |

Consumer-to-Consumer: Transactions between individual consumers |

|

C2B |

Consumer-to-Business: Consumers offering products or services to businesses |

|

B2G |

Business-to-Government: Businesses providing goods or services to government agencies |

Choosing the Right E-Commerce Model

Selecting the ideal model depends on your target market, products or services, and long-term goals. At Good Payments Merchant Services, we guide you through the decision-making process by evaluating key business factors:

- Target Audience – Identify who your customers are and how they buy.

- Sales Channels – Choose marketing platforms that align with your business model.

- Payment Processing – Ensure secure, scalable, and flexible payment options.

- Platform Usability – Select an e-commerce platform that supports user-friendly and mobile-optimized experiences.

- Performance Tracking – Use real-time analytics and reporting to monitor sales and customer behavior.

Here’s a quick reference on what to consider for each model:

|

Model |

Key Considerations |

|

B2B |

Contract terms, recurring payments, bulk pricing |

|

B2C |

UX design, speed of checkout, loyalty programs |

|

C2C |

Platform trust, user verification, peer reviews |

|

C2B |

Custom quote tools, reverse auction models |

|

B2G |

Compliance requirements, procurement standards |

Good Payments Merchant Services is here to help you implement the right model with customized payment solutions, fraud prevention, and real-time reporting tools to support your growth and enhance customer trust.

The Rise of Virtual Payment Solutions

As the digital economy continues to evolve, virtual payment solutions have become a cornerstone of modern commerce. At Good Payments Merchant Services, we help businesses embrace this transformation by offering secure, flexible, and user-friendly virtual payment systems.

Driven by the surge in e-commerce and mobile technology, virtual payments allow your customers to make secure transactions from anywhere in the world. According to recent market research, the global virtual payment market is projected to reach $6.4 billion by 2025, with a CAGR of 22.4%—a clear sign that digital payments are here to stay.

What Are Virtual Payment Solutions?

Virtual payment solutions refer to non-physical methods of completing financial transactions online. These include:

- Digital wallets (e.g., Apple Pay, Google Pay)

- Online payment gateways

- Mobile payment apps

- Virtual terminals

These solutions allow businesses to accept payments securely and efficiently without relying on cash or traditional card terminals. With an internet connection and a secure platform, you can process transactions 24/7 from virtually anywhere.

Benefits of Using Virtual Payment Solutions

At Good Payments Merchant Services, we equip your business with cutting-edge virtual payment tools that provide measurable advantages:

Increased Sales & Customer Reach

Virtual payments remove geographic and time limitations, enabling your business to serve local and international customers seamlessly.

Enhanced Security

Our virtual solutions utilize encryption, tokenization, and PCI-compliant systems to reduce fraud risks and protect sensitive customer data.

Lower Transaction Costs

Eliminate the overhead of traditional payment infrastructure and benefit from lower processing fees and faster settlements.

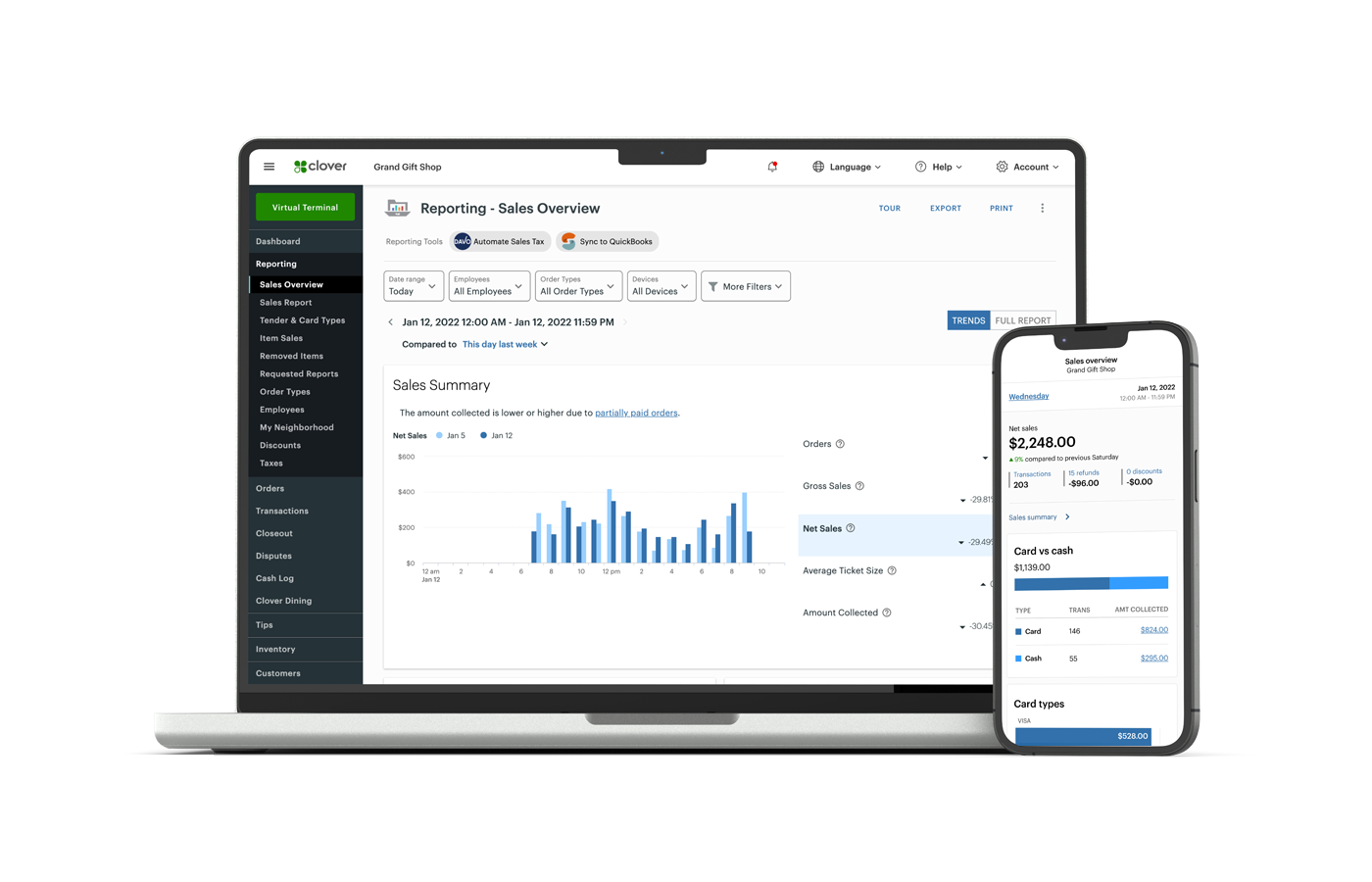

Real-Time Reporting & Analytics

Access detailed transaction data and performance insights that empower you to make informed business decisions.

Optimized for Mobile & Multi-Device Use

With more consumers using smartphones to shop, our virtual payment solutions are mobile-optimized to ensure a seamless checkout experience on any device.

Why Virtual Payments Matter

In today’s fast-paced retail environment, offering convenient, secure, and modern payment methods isn’t just a luxury—it’s a necessity. Virtual payment solutions not only enhance customer satisfaction but also position your business as forward-thinking and adaptable in an increasingly digital marketplace.

Ready to streamline your transactions and grow your business online? Partner with Good Payments Merchant Services for secure, scalable, and customized virtual payment solutions.

Key Features of Good Payments Merchant Services

Your success in e-commerce begins with a reliable, secure, and scalable payment processing solution. At Good Payments Merchant Services, we offer a robust suite of features designed to support the growth and efficiency of your online business.

Essential Features That Power Your Business

When evaluating merchant service providers, it’s important to look for features that meet your specific operational and customer service needs. Our solutions include:

- Multi-Currency Support – Accept payments from global customers with real-time currency conversion.

- Real-Time Transaction Processing – Speed up checkouts and improve customer satisfaction.

- Customizable Payment Gateways – Tailor your gateway experience to match your branding and workflow.

- Advanced Security Protocols – Benefit from tokenization, encryption, PCI-DSS compliance, and two-factor authentication.

- Transparent Pricing – No hidden fees—just clear, straightforward pricing that fits your budget.

- Scalability – Seamlessly handle increasing transaction volumes as your business grows.

- Comprehensive Reporting & Analytics – Gain actionable insights through real-time dashboards and detailed reports.

These features not only enhance your operational efficiency but also create a smooth, reliable experience for your customers at checkout.

Built-In Security & Fraud Prevention

At Good Payments Merchant Services, security is non-negotiable. Our systems are designed to protect you and your customers from fraud, chargebacks, and data breaches. Key security features include:

- End-to-end encryption and tokenization

- Real-time fraud monitoring

- Two-factor authentication

- Compliance with PCI-DSS and GDPR standards

We actively monitor suspicious activity and provide real-time alerts, ensuring your business maintains a strong reputation for safety and trust.

Seamless Integration with Your E-Commerce Stack

Our payment solutions are built for flexibility. Whether you’re running a custom-built store or using platforms like Shopify, WooCommerce, or Magento, we make integration simple.

- Easy-to-use APIs and SDKs

- Plug-ins for major shopping carts

- Quick setup and sandbox testing

With Good Payments Merchant Services, you can launch fast, reduce technical overhead, and start accepting payments with minimal disruption.

Why It Matters

Choosing the right payment processor goes beyond transactions—it’s about creating a secure, scalable, and frictionless experience that fuels your growth. With our powerful features, expert support, and user-first design, we ensure your payment infrastructure keeps pace with your business goals.

Get started today with Good Payments Merchant Services—trusted, secure, and ready to scale with you.

Choosing the Right Payment Processor

Selecting the right payment processor is essential to the success of any e-commerce business. At Good Payments Merchant Services, we understand that every business has unique needs—and we’re here to help you make an informed choice.

Whether you’re just launching your online store or scaling an established brand, it’s important to evaluate your payment processing partner based on security, cost, compatibility, and support.

What to Consider When Choosing a Payment Processor

When comparing providers, consider these critical factors:

- Payment Gateway Compatibility – Ensure the processor integrates seamlessly with your website, shopping cart, and CRM tools.

- Transaction Fees & Pricing Models – Look for clear, competitive pricing with no hidden fees.

- Security & Compliance – Choose a PCI-DSS compliant provider with encryption, tokenization, and fraud prevention measures.

- Accepted Payment Types – Support for credit/debit cards, digital wallets, ACH, and recurring billing is essential.

- Customer Support – Round-the-clock technical assistance can make all the difference in maintaining business continuity.

- Scalability – Your payment solution should grow with your business.

By selecting a processor that aligns with your business goals and operational needs, you ensure a secure, seamless, and efficient payment experience for both you and your customers.

Comparing Payment Processors: Why Good Payments Merchant Services Stands Out

Choosing the right payment processor is essential for running a smooth and secure business. While many providers offer similar services, Good Payments Merchant Services delivers greater value through competitive rates, enhanced security, and exceptional support.

Successful E-Commerce Strategies for Growth

A well-executed e-commerce strategy is essential for the success of your online business. With over 2.1 billion digital buyers globally, the opportunity to scale and reach wider audiences has never been greater. To remain competitive, businesses must implement forward-thinking e-commerce practices that deliver convenience, security, and satisfaction.

At Good Payments Merchant Services, we support your growth by providing secure, user-friendly payment solutions that integrate seamlessly with your e-commerce operations—ensuring your business stays agile and competitive in an evolving digital marketplace.

Why Seamless Checkout Matters

One of the most critical elements of a high-converting e-commerce strategy is a frictionless checkout experience. Research shows that 27% of customers abandon their carts due to complex or time-consuming checkout processes. Streamlining this step can significantly boost conversions and customer satisfaction.

Good Payments Merchant Services helps reduce checkout friction by offering:

- Fast, secure payment gateways

- Multiple payment options (credit/debit cards, PayPal, mobile wallets)

- Guest checkout functionality

- Clear order summaries and calls-to-action

With our tailored checkout solutions, you can decrease cart abandonment, increase retention, and deliver a superior customer experience.

Building Trust in Your Online Store

Trust is the foundation of any successful online business. Consumers want reassurance that their data is secure and their transactions are handled professionally. That’s why Good Payments Merchant Services emphasizes transparency and reliability in every transaction.

We help you build trust through:

- PCI-DSS compliant payment processing

- SSL encryption and fraud detection tools

- Clear pricing and real-time transaction tracking

- 24/7 customer support for you and your clients

To further strengthen credibility, incorporate social proof like verified reviews, testimonials, and trust badges. These elements signal professionalism and integrity, critical for attracting and retaining loyal customers.

Partner with a Payment Processor That Drives Results

From optimizing your checkout flow to securing customer data, Good Payments Merchant Services is your dedicated partner in crafting a winning e-commerce strategy. Our scalable solutions are designed to grow with your business, helping you build trust, boost sales, and create an experience your customers will keep coming back to.

Why Choose Good Payments Merchant Services for E-Commerce & Virtual Payment Solutions

When it comes to powering your online business, choosing the right payment partner is crucial. At Good Payments Merchant Services, we combine industry expertise with advanced technology to deliver secure, seamless, and flexible e-commerce and virtual payment solutions. With 75% of online shoppers preferring digital payments, partnering with us positions your business to meet modern expectations and tap into a growing global market.

Enhanced Customer Experience

A smooth and reliable checkout experience directly impacts your sales and customer satisfaction. That’s why our payment solutions are designed to support a frictionless customer journey from browsing to payment confirmation. With multiple payment options—including credit/debit cards, digital wallets, and online gateways—you can cater to diverse preferences and increase your conversion rates.

Our intuitive payment interfaces and fast processing times reduce friction at checkout, helping you turn browsers into buyers while building long-term loyalty. Businesses that offer flexible payment methods see significant increases in revenue and retention, and we’re here to help you do just that.

Competitive Pricing & Transparent Fees

Running a profitable online business means keeping costs in check without compromising on quality. At Good Payments Merchant Services, we offer transparent, cost-effective pricing models tailored to your business size and needs. Our rates are up to 20% lower than industry averages, helping you save on transaction fees without sacrificing service or security.

With no hidden charges and flexible plans, you get full control over your payment processing costs. Our clients typically experience up to 30% savings, which can be reinvested into marketing, operations, or innovation—fueling sustainable growth.

Comprehensive Tools & Insights

Beyond transaction processing, we provide powerful analytics and reporting tools to help you monitor payment trends, customer behaviors, and sales performance. This valuable data empowers smarter business decisions and better marketing strategies.

Combined with our dedicated customer support, you’ll always have expert guidance available whether you’re setting up for the first time or scaling your existing operations.

Your Trusted Partner in E-Commerce

Choosing Good Payments Merchant Services means choosing a partner invested in your success. We make payment processing simple, secure, and scalable—so you can focus on what you do best: growing your business and delighting your customers.

Frequently Asked Questions(FAQs)

Q: What is E-Commerce and how does it benefit my business?

A: E-Commerce, also known as electronic commerce, refers to the buying and selling of goods and services over the internet. It benefits your business by providing a global marketplace, increasing customer reach, and reducing operational costs. At Good Payments Merchant Services, we offer secure and reliable e-commerce solutions to help you expand your customer base and grow your business.

Q: How do I accept payments online and what are the available options?

A: To accept payments online, you need a payment gateway that can process transactions securely. At Good Payments Merchant Services, we offer a range of payment options, including credit/debit card processing, PayPal, and other digital payment methods. Our payment gateways are designed to be secure, fast, and easy to integrate with your e-commerce platform, ensuring a seamless payment experience for your customers.

Q: What are the advantages of using virtual payment terminals for my business?

A: Virtual payment terminals offer several advantages, including increased flexibility, reduced costs, and enhanced security. With a virtual payment terminal, you can process payments from anywhere, at any time, without the need for physical equipment. At Good Payments Merchant Services, our virtual payment terminals are designed to be user-friendly, secure, and compliant with industry standards, ensuring that your business can process payments efficiently and effectively.

Q: How does Good Payments Merchant Services ensure the security of my online transactions?

A: At Good Payments Merchant Services, we take the security of your online transactions very seriously. We use advanced encryption technology, such as SSL and TLS, to protect sensitive data and prevent unauthorized access. Our payment gateways and virtual payment terminals are also compliant with industry standards, including PCI-DSS, to ensure that your transactions are secure and reliable. Additionally, we offer fraud protection and monitoring services to help prevent and detect suspicious activity.

Q: Why should I choose Good Payments Merchant Services for my E-Commerce and Virtual payment needs?

A: At Good Payments Merchant Services, we offer a range of benefits that set us apart from other payment providers. Our e-commerce solutions are designed to be secure, reliable, and easy to use, with competitive pricing and flexible payment options. We also offer dedicated customer support, ensuring that you can get help whenever you need it. By choosing Good Payments Merchant Services, you can trust that your online transactions are in good hands, and that you have a partner who is committed to helping your business succeed.

Solutions For All Types Of Payments

Contact Info

Location

1776 N Scottsdale Road #8252

Scottsdale, Arizona 85252

Phone

Flexible Payment Solutions to Power Your Business

Whether you’re at the counter, on the go, or selling online, we provide the right tools to accept payments with ease. Discover a full suite of POS systems and processing solutions built to grow with you.

Clover Family

CardPointe Suite

Wireless & Mobile

Our wireless and mobile POS systems are designed for businesses on the move. Equipped for WiFi and 5G connectivity, these devices accept a full range of payments including credit, debit, EBT, gift cards, and checks. The “store-and-forward” feature ensures transactions are saved even when there’s no signal—giving you peace of mind wherever business takes you. It’s perfect for food trucks, service providers, and vendors who need flexibility without sacrificing reliability.

Stand Alone Terminals

Our stand-alone terminals offer a straightforward, dependable way to accept payments without the need for a full POS system. Designed for businesses that want simplicity, these terminals support a wide range of payment types including chip cards, contactless payments, and more. With options for wireless or ethernet connectivity and easy integration into your existing setup, our terminals provide secure, fast, and efficient transaction processing for any business environment.

E-Commerce & Virtual Terminals

Expand your reach and take payments online with our e-commerce and virtual terminal solutions. Whether you run a full online store or need a way to invoice customers remotely, we provide secure tools to process credit card transactions over the web. Our virtual terminals allow you to key in payments from any device with internet access, offering flexibility and efficiency without needing physical hardware. It’s ideal for service-based businesses, remote teams, and digital retailers.

Zero Cost Processing

Our Zero Cost Processing program helps businesses save money by offsetting credit card processing fees through legal and compliant methods. Using either a Cash Discount or Surcharge Program, you can build the cost of processing into your pricing or pass a small fee directly to customers who choose to pay with cards. This innovative approach reduces your overhead while maintaining transparency with customers—and it’s fully compliant with current regulations.

Agent and ISO Program

If you’re a sales agent or ISO in the merchant services industry, our Agent and ISO Program is built to help you succeed. We offer the support, tools, and resources you need to close deals faster, retain more clients, and scale your business. With competitive payouts, real-time reporting, marketing materials, and access to industry-leading payment solutions, you and your merchants become part of a team committed to shared success. Join us and start growing today.

E-commerce Payment Gateway Phoenix: Complete Guide to Secure Payment Processing Phoenix for Online Business Success

Phoenix businesses searching for “E-commerce Payment Gateway near me” are discovering the critical importance of robust online payment infrastructure for digital commerce success. E-commerce Payment Gateway Phoenix solutions from Good Payments Merchant Services provide the secure, reliable foundation that Valley businesses need to compete in today’s digital marketplace. Our comprehensive E-commerce Payment Gateway offerings integrate seamlessly with existing business operations while delivering secure online payments that protect both merchants and customers throughout every transaction. Whether you’re launching your first online store in Scottsdale or expanding an established Phoenix retail operation into digital channels, our payment processing Phoenix expertise ensures your e-commerce platform operates with enterprise-level security, optimal performance, and maximum conversion rates that drive business growth.

Key Takeaways

- Seamless Platform Integration: Professional e-commerce payment gateways integrate with all major platforms including Shopify, WooCommerce, Magento, and custom solutions, ensuring smooth implementation for Phoenix businesses

- Enhanced Security Standards: Advanced fraud protection, PCI DSS compliance, and SSL encryption provide enterprise-level security that protects both businesses and customers during online transactions

- Multiple Payment Options: Support for credit cards, digital wallets, buy-now-pay-later services, and international payment methods maximizes customer convenience and conversion rates

- Real-Time Processing: Instant transaction authorization and settlement improve cash flow while providing immediate order confirmation for enhanced customer satisfaction

- Mobile Commerce Optimization: Responsive payment forms and mobile wallet integration ensure optimal checkout experiences across all devices and platforms

- Comprehensive Analytics: Detailed reporting and conversion tracking provide actionable insights for optimizing payment processes and increasing online revenue

- Local Phoenix Support: Good Payments Merchant Services offers personalized consultation, technical implementation, and ongoing support specifically tailored to Valley business needs

E-commerce Payment Gateway Fundamentals

E-commerce payment gateways serve as the critical bridge between online stores and payment processors, securely transmitting customer payment information while ensuring seamless transaction completion. Phoenix businesses rely on these sophisticated systems to handle the complex process of authorizing, capturing, and settling online payments while maintaining the highest security standards and optimal user experience.

Understanding the distinction between payment gateways and payment processors helps Phoenix businesses make informed decisions about their e-commerce infrastructure. While processors handle the actual movement of funds between banks, gateways manage the secure transmission of payment data and provide the technical interface that connects websites to the broader payment ecosystem.

Professional gateway solutions offer significant advantages over basic payment processing options, including advanced fraud protection, comprehensive reporting capabilities, and extensive customization options that enhance both security and user experience. Phoenix businesses implementing professional gateways often experience improved conversion rates, reduced chargebacks, and enhanced customer confidence in their online purchasing process.

Modern payment gateways integrate seamlessly with existing e-commerce platforms, business management systems, and accounting software, creating unified operational workflows that streamline order processing and financial management. This integration capability proves essential for Phoenix businesses seeking to optimize their digital commerce operations while maintaining operational efficiency.

Comprehensive E-commerce Gateway Solutions

Hosted Payment Pages provide secure, off-site payment processing that reduces PCI compliance requirements while maintaining professional appearance and functionality. Phoenix businesses benefit from reduced security liability while ensuring customers experience smooth, secure checkout processes that build confidence and encourage completion.

API Integration enables custom payment form development that seamlessly blends with website design while providing maximum flexibility for unique business requirements. Phoenix businesses can create tailored checkout experiences that reflect their brand identity while maintaining enterprise-level security and functionality.

Shopping Cart Plugins offer pre-built integrations with popular e-commerce platforms, enabling rapid implementation without extensive technical development. These solutions provide Phoenix businesses with proven functionality that reduces implementation time while ensuring compatibility with existing systems and workflows.

Mobile Commerce Gateways optimize payment processing for smartphones and tablets, ensuring fast, secure transactions across all devices. Phoenix businesses can capture mobile commerce opportunities while providing convenient checkout experiences that accommodate changing customer preferences and shopping behaviors.

Subscription Management capabilities automate recurring billing for membership sites, software services, and subscription-based businesses throughout Phoenix. These features handle complex billing scenarios including trial periods, upgrades, and cancellations while maintaining customer satisfaction and reducing administrative overhead.

Virtual Terminal & Remote Payment Processing

Browser-based payment processing through virtual terminals enables Phoenix businesses to accept payments from any internet-connected device without requiring specialized software or hardware. This flexibility proves essential for businesses processing phone orders, handling customer service payments, or managing transactions from multiple locations throughout the Valley.

Phone order and mail order (MOTO) transaction handling provides secure processing capabilities for businesses accepting payments through traditional channels. Phoenix businesses can maintain comprehensive payment acceptance while ensuring consistent security standards across all transaction types and customer interaction methods.

Remote invoicing and payment collection tools streamline accounts receivable management by enabling automated invoice delivery and online payment acceptance. These capabilities improve cash flow for Phoenix service providers, professional practices, and B2B businesses while reducing administrative overhead and payment processing delays.

Multi-user access controls enable Phoenix businesses to provide payment processing capabilities to multiple employees while maintaining security and accountability through individual login credentials and customizable permission levels. Managers can monitor activity and maintain oversight while distributing payment processing responsibilities efficiently.

Customer payment portals and self-service options empower customers to manage their accounts, view payment history, and process payments independently. Phoenix businesses benefit from reduced customer service overhead while providing convenient, 24/7 payment access that improves customer satisfaction and retention.

Security & Fraud Protection Features

PCI DSS compliance certification ensures Phoenix businesses meet the highest payment security standards while receiving ongoing support for maintaining certification requirements. Professional gateway solutions include compliance monitoring and reporting tools that simplify the complex process of maintaining security certifications without overwhelming administrative burden.

SSL encryption and secure data transmission protect sensitive customer information throughout the entire payment process, from initial form submission through final transaction completion. Phoenix businesses can assure customers that their payment data remains protected while meeting industry security requirements and building customer confidence.

Advanced fraud detection and prevention tools utilize machine learning algorithms and real-time risk analysis to identify potentially fraudulent transactions before they impact business operations. These systems analyze transaction patterns, customer behavior, and geographic data to provide comprehensive protection while minimizing false positives that could affect legitimate customers.

Address verification service (AVS) and CVV checking provide additional layers of transaction security by verifying customer-provided information against bank records. Phoenix businesses can reduce fraud risk while maintaining smooth checkout experiences for legitimate customers through automated verification processes.

3D Secure authentication adds an extra layer of protection for online transactions by requiring customer authentication through their card-issuing bank. This technology shifts fraud liability while providing enhanced security for high-value transactions and international payments.

E-commerce Platform Integrations

Shopify integration provides seamless payment gateway connectivity with one of the world’s most popular e-commerce platforms. Phoenix businesses using Shopify can implement professional payment processing with minimal technical complexity while maintaining access to advanced features and customization options.

WooCommerce solutions enable WordPress-based online stores to accept payments through professional gateways with extensive customization capabilities. Phoenix businesses benefit from the flexibility of WordPress combined with enterprise-level payment processing functionality and security.

Magento integration supports enterprise-level online stores with complex product catalogs, multiple store views, and advanced e-commerce functionality. Phoenix businesses requiring sophisticated online retail capabilities can implement professional payment processing that scales with their operational requirements.

BigCommerce platform support provides scalable e-commerce solutions with built-in payment gateway integration for growing Phoenix businesses. These implementations offer comprehensive functionality while maintaining simplicity for businesses seeking powerful online retail capabilities without technical complexity.

Custom Platform API-based integrations enable Phoenix businesses with unique requirements to implement professional payment processing regardless of their existing technology infrastructure. Custom solutions provide maximum flexibility while ensuring compatibility with specialized business systems and workflows.

Payment Methods & Customer Options

Credit and debit card processing supports all major card brands including Visa, MasterCard, Discover, and American Express with competitive interchange rates and fast authorization times. Phoenix businesses can accommodate customer preferences while maintaining cost-effective processing expenses and reliable transaction completion.

Digital wallet acceptance includes PayPal, Apple Pay, Google Pay, and other popular payment methods that customers increasingly expect for online purchases. These options provide enhanced security and convenience while often improving conversion rates through streamlined checkout processes.

Buy now, pay later (BNPL) integration options enable Phoenix businesses to offer flexible payment terms through services like Klarna, Afterpay, and Affirm. These solutions can increase average order values and conversion rates while providing customers with attractive financing options at no cost to merchants.

International payment processing and multi-currency support enable Phoenix businesses to accept payments from global customers with automatic currency conversion and competitive exchange rates. These capabilities open new markets while simplifying international commerce management and reducing customer friction.

ACH/bank transfer and alternative payment methods provide cost-effective processing options for large transactions while accommodating customers who prefer direct bank payments. Phoenix businesses can reduce processing costs for high-value orders while providing additional payment flexibility.

Good Payments Merchant Services E-commerce Advantage

Local Phoenix consultation and implementation services ensure optimal gateway configuration based on specific business requirements, customer demographics, and operational goals. Our team provides personalized analysis and recommendations that maximize conversion rates while minimizing processing costs and security risks.

Competitive gateway and processing rates reflect our commitment to providing exceptional value for Phoenix businesses implementing e-commerce solutions. We analyze transaction patterns and business requirements to develop customized pricing that often results in significant cost savings compared to standard gateway providers.

Technical support and ongoing maintenance include 24/7 assistance, regular system updates, and proactive monitoring to ensure consistent gateway performance. Phoenix businesses can focus on growing their online sales while we maintain their payment infrastructure and resolve technical issues quickly.

Custom integration development and optimization services enable Phoenix businesses with unique requirements to implement tailored payment solutions that integrate seamlessly with existing systems. Our technical team provides specialized development services that ensure optimal performance and functionality.

Performance monitoring and conversion rate optimization include ongoing analysis of payment processes, checkout abandonment rates, and customer behavior patterns. We provide recommendations and implementations that improve conversion rates and maximize online revenue for Phoenix businesses.

Mobile Commerce & Responsive Design

Mobile-optimized payment forms and checkout processes ensure seamless payment acceptance across smartphones and tablets with fast loading times and intuitive interfaces. Phoenix businesses can capture the growing mobile commerce market while providing excellent user experiences that encourage transaction completion.

Progressive web app (PWA) payment integration enables app-like experiences through web browsers with offline capabilities and push notifications. These implementations provide enhanced functionality while avoiding the complexity and cost of native mobile app development.

Cross-device payment session management allows customers to begin transactions on one device and complete them on another without losing progress or stored information. This capability accommodates modern shopping behaviors while reducing abandonment rates and improving customer satisfaction.

Mobile wallet and contactless payment support includes integration with popular services like Apple Pay, Google Pay, and Samsung Pay for convenient, secure mobile transactions. Phoenix businesses can provide the payment methods that mobile customers prefer while maintaining security and processing efficiency.

Subscription & Recurring Billing Management

Automated recurring payment processing handles complex billing scenarios including different subscription tiers, billing cycles, and payment timing requirements. Phoenix businesses can efficiently manage subscription services while reducing administrative overhead and ensuring consistent revenue collection.

Customer subscription management portals enable self-service account management, payment method updates, and subscription modifications. These features reduce customer service overhead while providing convenient account access that improves customer satisfaction and retention.

Failed payment retry logic and dunning management automatically attempt to collect failed payments using intelligent retry schedules and customer communication sequences. Phoenix businesses can maximize revenue recovery while maintaining positive customer relationships through professional, automated processes.

Proration and billing cycle customization accommodate complex pricing structures and subscription changes with accurate calculation and transparent customer communication. These capabilities enable flexible subscription offerings while maintaining accurate financial records and customer trust.

Phoenix E-commerce Success Stories

Local Phoenix retailers have dramatically increased online sales conversion rates through professional payment gateway implementations that provide multiple payment options and optimized checkout processes. One popular Scottsdale boutique reported a 45% increase in online conversion rates after implementing comprehensive payment gateway solutions with mobile optimization.

Subscription-based Phoenix businesses have streamlined billing operations and reduced customer churn through automated payment processing and customer self-service portals. A Valley fitness studio reduced administrative overhead by 60% while improving member satisfaction through convenient online account management and payment processing.

Phoenix service providers have accelerated payment collection and improved cash flow through integrated invoicing and online payment systems. Professional practices throughout the Valley report faster payment collection and reduced administrative costs after implementing comprehensive e-commerce payment solutions.

Multi-location Phoenix businesses have unified their online and in-store payment processing through integrated gateway solutions that provide consistent customer experiences across all channels. These implementations enable comprehensive business management while maintaining operational efficiency and customer satisfaction.

Ready to transform your Phoenix business with professional e-commerce payment gateway solutions? Contact Good Payments Merchant Services today for your complimentary e-commerce consultation and discover how our secure, reliable payment processing Phoenix expertise can maximize your online revenue while protecting your business and customers through every digital transaction.

Frequently Asked Questions

Q: What’s the difference between payment gateways and payment processors for Phoenix e-commerce businesses?

A: Payment gateways handle the secure transmission of payment data between your website and the payment processor, while processors actually move funds between banks. Think of gateways as the technology that connects your online store to the payment system, providing security, fraud protection, and integration capabilities. Phoenix businesses need both components working together for complete e-commerce payment processing.

Q: How much do e-commerce payment gateways cost for Phoenix businesses?

A: Gateway costs typically include setup fees ($0-500), monthly gateway fees ($10-50), and per-transaction fees ($0.10-0.30), plus standard processing rates for card transactions. Good Payments Merchant Services offers competitive pricing with transparent fee structures tailored to your transaction volume and business type. Many Phoenix businesses find our gateway solutions provide better value than national providers while including local support.

Q: Can e-commerce payment gateways integrate with my existing Phoenix business website?

A: Yes, professional payment gateways integrate with virtually any website or e-commerce platform through APIs, plugins, or hosted payment pages. Good Payments Merchant Services supports integration with popular platforms like Shopify, WooCommerce, Magento, and custom-built websites. Our technical team handles the integration process to ensure seamless implementation with your existing Phoenix business systems.

Q: How secure are e-commerce payment gateways for protecting customer data?

A: Modern payment gateways provide enterprise-level security including PCI DSS compliance, SSL encryption, tokenization, and advanced fraud detection. These systems often provide better security than storing payment information on your own servers. Good Payments Merchant Services ensures all gateway implementations meet the highest security standards while simplifying compliance requirements for Phoenix businesses.

Q: What payment methods can customers use with e-commerce payment gateways?

A: Professional gateways support credit cards, debit cards, digital wallets (Apple Pay, Google Pay, PayPal), ACH/bank transfers, and buy-now-pay-later services. International payment processing and multiple currencies are also available for Phoenix businesses serving global customers. We configure gateways to accept the payment methods your customers prefer while optimizing conversion rates.

Q: How quickly can Good Payments Merchant Services implement e-commerce payment gateways for Phoenix businesses?

A: Most gateway implementations are completed within 3-7 business days, depending on complexity and integration requirements. Simple plugin installations can often be completed within 24-48 hours, while custom integrations may require additional development time. Our Phoenix team coordinates implementation to minimize business disruption while ensuring thorough testing and training.

Q: Do e-commerce payment gateways work for mobile commerce and smartphone purchases?

A: Yes, modern payment gateways are optimized for mobile devices with responsive design, mobile wallet integration, and fast checkout processes. Phoenix businesses can accept payments seamlessly across desktop computers, tablets, and smartphones while providing consistent security and user experience. Mobile optimization often significantly improves conversion rates for online businesses.