Zero Cost Processing

Save More. Grow Faster. Process Payments Without the Fees.

At Good Payments Merchant Services, we understand that every dollar counts. That’s why we offer Zero Cost Processing—a cutting-edge solution designed to eliminate credit card processing fees, so your business can keep more of its revenue and reinvest it into growth.

Let's Get Started

Not sure where to start? Call us and our merchant services experts will guide you to the perfect solution that meets your needs.

What Is Zero Cost Processing?

Zero Cost Processing is a payment model that allows you to pass processing fees directly to your customers—meaning you pay nothing out of pocket. This method is fully compliant, transparent, and increasingly popular among merchants looking to improve their bottom line without sacrificing customer satisfaction.

Instead of absorbing the typical 2–4% in transaction fees, your customers see a small service charge during checkout—clearly disclosed—while you retain 100% of the sale.

Understanding Zero Cost Processing

At Good Payments Merchant Services, we believe in simplifying payment processing while helping businesses protect their profits. While the term Zero Cost Processing may sound complex, the concept is straightforward—and highly effective.

Traditional credit card processing typically costs businesses 2%–4% per transaction, cutting into revenue, especially at scale. Zero Cost Processing eliminates these costs by passing a small, fully disclosed surcharge to the customer at the point of sale. This model allows businesses to retain 100% of the transaction amount, boosting cash flow and improving profitability.

How Zero Cost Processing Works

Implementing Zero Cost Processing with Good Payments Merchant Services is simple and compliant:

- A small service fee is added to each credit card transaction.

- The customer pays the surcharge, not the business.

- The business receives the full sale amount, with no processing fees deducted.

This approach is transparent, legally compliant, and easy to integrate into your existing POS systems or e-commerce platforms. Our team ensures you meet all card brand regulations and disclosure requirements, keeping your operations aligned with industry standards.

Benefits of Zero Cost Processing

At Good Payments Merchant Services, we understand that every dollar matters when running a business. That’s why we offer Zero Cost Processing, a powerful solution that helps businesses reduce expenses and increase profitability. Instead of absorbing credit card processing fees, this model allows businesses to pass them on to customers transparently—keeping more revenue where it belongs: in your business.

Lower Transaction Costs

Traditional payment processing fees average 2–3% per transaction, which can significantly impact profit margins over time. With Zero Cost Processing, these fees are transferred to the customer at checkout, allowing your business to retain 100% of each sale.

Example:

If your business processes $100,000 monthly, Zero Cost Processing could save $2,000 to $3,000—funds you can reinvest into operations, staffing, marketing, or growth initiatives.

Improved Cash Flow

Healthy cash flow is essential for maintaining day-to-day operations and scaling your business. Zero Cost Processing allows you to:

- Keep more of each transaction

- Reduce operating expenses

- Increase available capital

Businesses that adopt Zero Cost Processing often report a 10% improvement in cash flow, giving them more flexibility to seize new opportunities and cover unexpected costs.

Increased Profit Margins

By eliminating processing fees, you boost your bottom line without raising product prices. This strategic advantage can help you:

- Stay competitive in pricing

- Fund business expansion

- Offer more customer incentives or discounts

At Good Payments Merchant Services, we help you implement Zero Cost Processing seamlessly and ensure compliance with all applicable surcharge rules and card brand guidelines.

Seamless Integration & Support

Transitioning to Zero Cost Processing is simple with Good Payments. We provide:

- Easy system integration

- Clear communication templates for customer transparency

- 24/7 support from industry experts

Our team ensures you’re fully equipped to implement this solution effectively while maintaining positive customer relationships.

A Smarter Way to Process Payments

With Zero Cost Processing, you’re not just cutting costs, you’re investing in long-term financial health. Let Good Payments Merchant Services help you optimize your payment strategy, enhance customer satisfaction, and increase profitability.

Ready to eliminate processing fees?

Contact us today to learn more about Zero Cost Processing and how it can transform your business.

How Good Payments Merchant Services Stands Out

In today’s competitive market, businesses need more than just a standard payment processor—they need a partner that understands their goals and delivers cost-effective, transparent, and tailored solutions. At Good Payments Merchant Services, we help you streamline your payment operations, increase profit margins, and create a seamless payment experience for your customers.

With innovative solutions like Zero Cost Processing, our platform empowers you to eliminate processing fees and reinvest your savings into growing your business.

Transparent Pricing, No Hidden Fees

At Good Payments Merchant Services, transparency is at the core of everything we do. We provide:

- Clear, upfront pricing

- No hidden fees

- Easy-to-understand statements

Our commitment to honest pricing means you can make confident financial decisions without unexpected costs. With Zero Cost Processing, you keep more of what you earn while maintaining compliance and transparency with your customers.

Dedicated Customer Support

We believe every business deserves personalized support. That’s why we offer:

- 24/7 live support via phone, email, or chat

- Dedicated account managers

- Expert onboarding and training

From initial setup to ongoing optimization, our team is here to guide you every step of the way—whether you need technical assistance or strategic advice on improving your payment workflows.

We don’t just process payments—we build relationships based on trust, transparency, and your long-term success.

Ready to Elevate Your Payment Experience?

Join the businesses that trust Good Payments Merchant Services to reduce costs, simplify transactions, and improve cash flow. Let us help you create a more profitable and efficient payment system—starting today.

Contact us now to get started.

Overcoming Common Concerns About Zero Cost Processing

At Good Payments Merchant Services, we understand that switching to a new payment model—especially one that sounds as cost-effective as Zero Cost Processing—can raise questions. It’s natural to wonder if it’s too good to be true or whether it’s suitable for your business. We’re here to address those concerns and provide clarity so you can make confident, informed decisions.

Clearing Up Common Misconceptions

Zero Cost Processing isn’t a gimmick—it’s a proven and legally compliant solution used by businesses across a wide range of industries. Contrary to common myths:

- It’s not limited to specific industries — Retail, restaurants, service providers, and e-commerce businesses are all eligible.

- It’s not a new or risky concept — Thousands of merchants have already adopted Zero Cost Processing to cut expenses and reinvest in growth.

- It doesn’t harm customer experience — When disclosed properly, most customers understand the small fee and appreciate the value and transparency.

By partnering with us, you’ll gain access to expert guidance to ensure implementation is smooth, legal, and aligned with your customer communication strategy.

Security and Compliance You Can Trust

Security is a top concern for any business handling payments. That’s why Good Payments Merchant Services uses industry-leading encryption and maintains full compliance with:

- PCI-DSS (Payment Card Industry Data Security Standards)

- GDPR (General Data Protection Regulation) for applicable businesses

With these safeguards in place, you can process payments confidently, knowing your customer data is protected and your operations meet all regulatory requirements.

In fact, studies show that businesses using compliant Zero Cost Processing models experience reduced fraud rates and improved financial transparency.

Why It’s the Smart Choice

Choosing Zero Cost Processing with Good Payments Merchant Services gives your business:

- More profit per transaction

- Lower operational costs

- Enhanced financial control

- Full transparency for your customers

We’re here to walk you through every step, ensuring you’re fully supported from setup to success.

Still Have Questions?

We’re here to help. Our team is ready to answer your questions and guide you through the process so you can take full advantage of Zero Cost Processing—safely, securely, and confidently.

Contact us today to learn more or schedule a free consultation.

How to Get Started with Zero Cost Processing

For businesses seeking to reduce overhead and boost profitability, Zero Cost Processing offers a simple, effective solution. This model allows you to pass payment processing fees to customers—legally and transparently—so you retain 100% of each sale. At Good Payments Merchant Services, we make it easy to adopt this approach and help you save more, sell more, and grow faster.

Why Choose Zero Cost Processing?

Traditional payment processing fees can chip away at your profits—typically 2–4% per transaction. With Zero Cost Processing, your business:

- Eliminates payment processing fees

- Improves cash flow

- Maintains competitive pricing

- Provides customers with secure, flexible payment options

Whether you run a brick-and-mortar store, an online business, or both, our solutions scale to your unique needs.

How to Enroll in Just a Few Steps

Getting started with Zero Cost Processing is fast, simple, and fully supported by our team:

- Schedule a Free Consultation

Connect with our experts to evaluate your business needs and ensure Zero Cost Processing is the right fit. - Complete a Quick Application

Submit basic business information online—takes just minutes. - Get Approved & Onboarded

Once approved, our onboarding team will walk you through setup, compliance, and customization to match your existing operations. - Go Live & Start Saving

You’ll be ready to process payments with Zero Cost Processing—saving instantly with each transaction.

Personalized Account Setup & Support

We don’t just hand over software—we partner with you every step of the way.

- Tailored payment settings for recurring billing, online checkout, and POS integration

- Dedicated support team for real-time guidance

- Training and resources to help you educate your team and customers

Whether you need help syncing with your current system or adjusting settings for your business model, we’re just a call or message away.

Start Saving Today

Thousands of businesses are already maximizing their revenue with Zero Cost Processing. Let us help you do the same.

Get Started Now or contact Good Payments Merchant Services to schedule your free consultation.

Why Choose Good Payments Merchant Services for Zero Cost Processing?

In today’s competitive business landscape, managing operational costs while delivering exceptional customer experiences is critical. One of the smartest ways to maximize profitability is by eliminating payment processing fees a benefit made possible through Zero Cost Processing. At Good Payments Merchant Services, we empower businesses to retain more of their revenue without compromising the quality or security of their payment systems.

Whether you’re a small business or a large enterprise, our Zero Cost Processing solutions are tailored to fit your operations, helping you improve cash flow, reduce expenses, and reinvest in growth. Here’s why more businesses are choosing Good Payments Merchant Services as their trusted partner.

Transparent, Compliant, and Proven Solutions

We prioritize honesty, compliance, and clarity. Our Zero Cost Processing model is fully compliant with all applicable regulations, including state surcharge laws and card network guidelines. We clearly communicate fee structures to your customers, ensuring a smooth transition and a positive payment experience. You’ll never be surprised by hidden charges—and your customers won’t either.

With a proven track record and years of industry expertise, our solutions are trusted by businesses across retail, e-commerce, food services, and more.

Seamless Integration with Personalized Support

Implementing Zero Cost Processing shouldn’t disrupt your daily operations—and with us, it won’t. We provide easy integration with your existing point-of-sale (POS), e-commerce, or mobile systems. Our onboarding process is fast, efficient, and fully supported by a dedicated account manager who understands your unique business needs.

From initial setup to long-term support, our team is available to guide you every step of the way, ensuring your payment processing is seamless, secure, and scalable.

Increased Profitability Without Sacrificing Flexibility

Our Zero Cost Processing program helps you eliminate up to 100% of your monthly credit card processing fees, improving your margins instantly. And while you reduce costs, your customers still enjoy flexible payment options, including major credit/debit cards and contactless transactions.

More savings mean more opportunities to invest in your team, expand your services, or enhance your marketing efforts. With Good Payments Merchant Services, you’re not just reducing expenses, you’re gaining a long-term partner in business growth.

Frequently Asked Questions(FAQs)

Q: What is Zero Cost Processing and how does it work?

A: Zero Cost Processing is a payment processing solution that allows businesses to accept credit card payments without incurring any processing fees. This is achieved by passing the processing fee on to the customer, typically in the form of a small service charge. At Good Payments Merchant Services, our Zero Cost Processing solution is designed to help businesses like yours save money on payment processing fees, while also providing a convenient and secure way for customers to make payments.

Q: How can Zero Cost Processing benefit my business?

A: By choosing Zero Cost Processing with Good Payments Merchant Services, your business can benefit from significant cost savings on payment processing fees. This can help increase your profit margins and improve your bottom line. Additionally, our Zero Cost Processing solution can help reduce the administrative burden associated with payment processing, allowing you to focus on running your business. With our solution, you can also provide your customers with a convenient and secure way to make payments, which can help improve customer satisfaction and loyalty.

Q: Is Zero Cost Processing compliant with industry regulations?

A: Yes, our Zero Cost Processing solution is fully compliant with all relevant industry regulations, including the Durbin Amendment and state laws governing payment processing. At Good Payments Merchant Services, we prioritize compliance and security, ensuring that our solutions meet the highest standards of integrity and transparency. Our team of experts is dedicated to staying up-to-date with the latest regulatory requirements, so you can trust that our Zero Cost Processing solution is always compliant and secure.

Q: How do I get started with Zero Cost Processing at Good Payments Merchant Services?

A: Getting started with Zero Cost Processing at Good Payments Merchant Services is easy. Simply contact our team of experts to discuss your payment processing needs and we will guide you through the setup process. We will work with you to ensure a seamless integration with your existing payment systems and provide ongoing support to ensure that you get the most out of our Zero Cost Processing solution. With our dedicated customer support team, you can trust that you will always have access to the help you need, when you need it.

Q: Why should I choose Good Payments Merchant Services for Zero Cost Processing?

A: At Good Payments Merchant Services, we are committed to providing our customers with the best possible payment processing solutions, including Zero Cost Processing. Our team of experts has years of experience in the payment processing industry and is dedicated to providing exceptional customer service and support. By choosing us for your Zero Cost Processing needs, you can trust that you are working with a reputable and reliable partner who is dedicated to helping your business succeed. With our competitive pricing, advanced security features, and personalized support, you can trust that you are getting the best possible value for your business.

Solutions For All Types Of Payments

Contact Info

Location

1776 N Scottsdale Road #8252

Scottsdale, Arizona 85252

Phone

Flexible Payment Solutions to Power Your Business

Whether you’re at the counter, on the go, or selling online, we provide the right tools to accept payments with ease. Discover a full suite of POS systems and processing solutions built to grow with you.

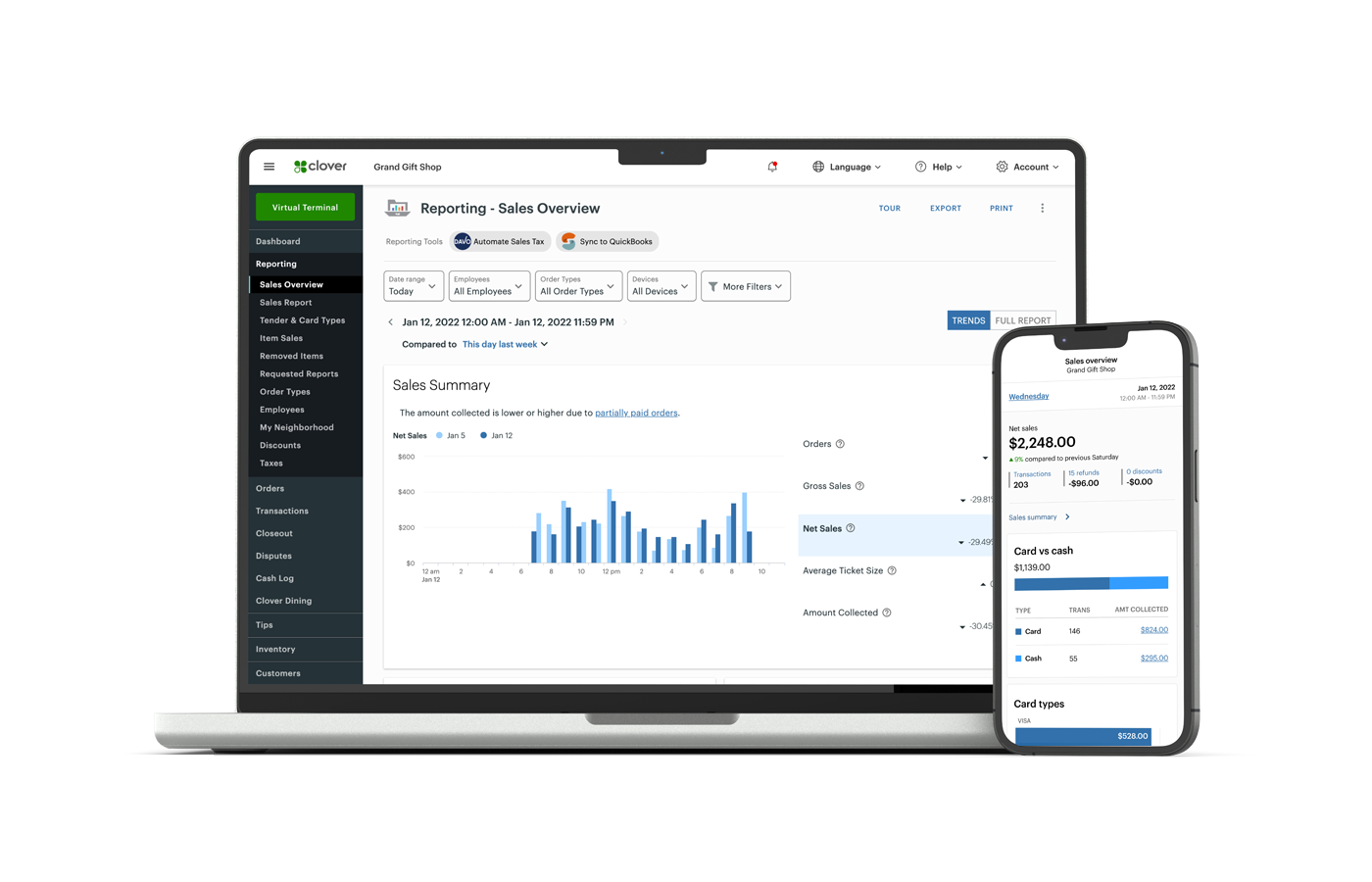

Clover Family

CardPointe Suite

Wireless & Mobile

Our wireless and mobile POS systems are designed for businesses on the move. Equipped for WiFi and 5G connectivity, these devices accept a full range of payments including credit, debit, EBT, gift cards, and checks. The “store-and-forward” feature ensures transactions are saved even when there’s no signal—giving you peace of mind wherever business takes you. It’s perfect for food trucks, service providers, and vendors who need flexibility without sacrificing reliability.

Stand Alone Terminals

Our stand-alone terminals offer a straightforward, dependable way to accept payments without the need for a full POS system. Designed for businesses that want simplicity, these terminals support a wide range of payment types including chip cards, contactless payments, and more. With options for wireless or ethernet connectivity and easy integration into your existing setup, our terminals provide secure, fast, and efficient transaction processing for any business environment.

E-Commerce & Virtual Terminals

Expand your reach and take payments online with our e-commerce and virtual terminal solutions. Whether you run a full online store or need a way to invoice customers remotely, we provide secure tools to process credit card transactions over the web. Our virtual terminals allow you to key in payments from any device with internet access, offering flexibility and efficiency without needing physical hardware. It’s ideal for service-based businesses, remote teams, and digital retailers.

Zero Cost Processing

Our Zero Cost Processing program helps businesses save money by offsetting credit card processing fees through legal and compliant methods. Using either a Cash Discount or Surcharge Program, you can build the cost of processing into your pricing or pass a small fee directly to customers who choose to pay with cards. This innovative approach reduces your overhead while maintaining transparency with customers—and it’s fully compliant with current regulations.

Agent and ISO Program

If you’re a sales agent or ISO in the merchant services industry, our Agent and ISO Program is built to help you succeed. We offer the support, tools, and resources you need to close deals faster, retain more clients, and scale your business. With competitive payouts, real-time reporting, marketing materials, and access to industry-leading payment solutions, you and your merchants become part of a team committed to shared success. Join us and start growing today.

Zero Cost Credit Card Processing Phoenix: Revolutionary Small Business Payment Solutions Phoenix That Eliminate Processing Fees

Phoenix small businesses searching for “Zero Cost Credit Card Processing near me” are discovering game-changing payment solutions that eliminate traditional processing expenses while maintaining professional service quality. Zero Cost Credit Card Processing Phoenix programs from Good Payments Merchant Services revolutionize how Valley businesses handle payment acceptance by transferring processing costs to customers through compliant surcharge programs. Our affordable payment processing solutions enable Phoenix entrepreneurs to reclaim thousands of dollars annually in processing fees while providing small business payment solutions Phoenix that enhance cash flow and profitability. Whether you’re operating a corner store in central Phoenix or managing a growing service business in Scottsdale, zero cost credit card processing transforms your payment acceptance from a business expense into a profit-neutral operation that supports sustainable growth throughout Arizona’s competitive marketplace.

Key Takeaways

- Complete Fee Elimination: Zero cost processing programs can eliminate 100% of credit card processing fees for Phoenix businesses through compliant surcharge or cash discount models

- Legal Compliance Assurance: Properly implemented programs meet all federal and Arizona state regulations while maintaining full card brand compliance and consumer protection standards

- Flexible Implementation Options: Multiple program types including surcharges, cash discounts, and dual pricing accommodate different business models and customer preferences

- Immediate Cost Savings: Phoenix businesses typically save $2,000-10,000+ annually in processing fees, with savings beginning immediately after program implementation

- Customer Acceptance Success: When properly implemented with appropriate communication and training, most customers accept zero cost programs without significant business impact

- Technology Integration: Modern POS systems automatically calculate and apply fees with transparent customer disclosure, ensuring compliance and professional presentation

- Local Phoenix Support: Good Payments Merchant Services provides comprehensive implementation, training, and ongoing compliance support specifically tailored to Valley business needs

Understanding Zero Cost Processing Fundamentals

Zero cost processing represents a paradigm shift in payment acceptance that enables Phoenix businesses to eliminate traditional processing expenses through legal, compliant fee transfer mechanisms. These programs work by adding a small service fee to credit card transactions while offering discounts for cash payments, effectively making payment processing cost-neutral for business owners.

The fundamental principle behind zero cost processing involves shifting the cost of payment acceptance from merchants to customers who choose to pay with credit cards. This approach recognizes that credit card processing provides convenience and benefits to customers, making it reasonable for them to bear the associated costs rather than requiring businesses to absorb these expenses.

Legal compliance forms the foundation of successful zero cost processing programs, with specific requirements for customer disclosure, signage, and fee calculation that ensure consumer protection while enabling business cost savings. Arizona regulations permit surcharge programs when properly implemented with appropriate disclosure and transparency.

Different program models accommodate various business types and customer preferences, from automated surcharge systems that add percentage-based fees to dual pricing structures that offer separate cash and card prices. Phoenix businesses can choose the approach that best fits their operational style and customer demographic.

Comprehensive Zero Cost Program Options

Credit Card Surcharge Programs automatically add a small percentage fee to credit card transactions, typically 3-4%, while clearly disclosing this fee to customers before transaction completion. Phoenix businesses benefit from complete processing fee elimination while maintaining transparent, compliant customer communication throughout the payment process.

Cash Discount Models offer reduced prices for cash payments while maintaining standard pricing for credit card transactions. This approach encourages cash usage while providing cost savings opportunities for price-sensitive customers throughout the Phoenix market.

Dual Pricing Systems display separate cash and credit card prices for products and services, allowing customers to choose their preferred payment method with full price transparency. Many Phoenix retailers find this approach provides maximum clarity while accommodating diverse customer preferences.

Hybrid Solutions combine multiple cost-reduction strategies to optimize savings while maintaining customer satisfaction and regulatory compliance. These customized approaches enable Phoenix businesses to maximize cost benefits while addressing specific operational requirements and customer demographics.

Custom Program Design accommodates unique business models, customer interactions, and operational requirements through tailored solutions that optimize cost savings while maintaining professional service quality and customer relationships.

Implementation Process and Requirements

Business eligibility assessment evaluates factors including business type, transaction volume, average ticket size, and customer demographic to determine optimal zero cost program configuration. Good Payments Merchant Services analyzes these factors to recommend the most effective approach for each Phoenix business.

Equipment and software requirements vary based on chosen program type, with most modern POS systems supporting automated surcharge calculation and customer disclosure. Implementation typically requires software updates or configuration changes rather than complete system replacement.

Staff training ensures team members understand program operation, customer communication requirements, and compliance obligations. Comprehensive training covers fee explanation, alternative payment promotion, and customer service best practices for maintaining positive relationships during program implementation.

Signage and disclosure requirements include prominent notification of surcharge programs at business entrances and payment terminals. These requirements ensure customer awareness while maintaining legal compliance and professional presentation throughout Phoenix business locations.

System setup and configuration involve programming automatic fee calculation, customer notification systems, and transaction documentation to ensure seamless operation and regulatory compliance. Professional installation ensures optimal system performance and compliance maintenance.

Technology Platform and Equipment

Point-of-sale system integration enables seamless zero cost program operation through automated fee calculation, customer notification, and transaction processing. Modern POS systems support zero cost processing without requiring extensive modification or replacement of existing equipment.

Automated surcharge calculation ensures accurate fee assessment based on transaction amount and payment method while maintaining compliance with card brand rules and regulatory requirements. Precise calculation eliminates manual errors while ensuring consistent program application.

Customer notification systems provide clear, prominent disclosure of surcharge fees before transaction completion, enabling informed customer decisions while maintaining transparency and compliance. Professional notification systems enhance customer understanding and acceptance.

Receipt printing and transaction documentation include detailed fee disclosure and program explanation to ensure customers receive complete transaction information while maintaining compliance with documentation requirements for business records and audit purposes.

Real-time processing and settlement capabilities ensure zero cost programs operate efficiently without impacting transaction speed or customer experience. Advanced processing systems maintain fast authorization times while accurately applying program parameters.

Industry-Specific Applications

Retail Businesses throughout Phoenix implement zero cost processing to eliminate expenses on product sales while maintaining competitive pricing and customer service quality. Automated systems handle fee calculation and customer notification seamlessly during checkout processes.

Restaurants & Food Service establishments use zero cost programs for both dine-in and takeout transactions, with staff training ensuring professional customer communication while maintaining positive dining experiences throughout the Valley.

Professional Services including legal offices, accounting firms, and consulting practices implement zero cost processing for client billing and retainer collection. Professional presentation and customer communication maintain client relationships while eliminating processing expenses.

Healthcare Practices utilize zero cost programs for patient copay collection and outstanding balance payments while maintaining HIPAA compliance and professional patient service standards throughout Phoenix medical facilities.

Service Industries including automotive repair, home improvement, and personal services implement mobile zero cost solutions for on-site payment collection while maintaining professional service delivery and customer satisfaction.

Legal Compliance and Regulations

Arizona state regulations permit surcharge programs when properly implemented with appropriate customer disclosure and fee limitations. Good Payments Merchant Services ensures Phoenix businesses maintain compliance with all state requirements while maximizing cost savings opportunities.

Federal regulations including Consumer Financial Protection Bureau guidelines establish standards for surcharge disclosure and customer protection that apply to all zero cost processing programs. Compliance monitoring ensures continued adherence to evolving regulatory requirements.

Card brand rules from Visa, MasterCard, Discover, and American Express establish specific requirements for surcharge programs including fee limitations, disclosure standards, and implementation procedures. Professional compliance management ensures adherence to all card brand requirements.

Documentation and record-keeping requirements include transaction records, customer notifications, and program compliance documentation for regulatory review and audit purposes. Comprehensive record management supports compliance maintenance and business protection.

Regular compliance monitoring includes ongoing regulatory update notification, program review, and adjustment recommendations to ensure continued compliance as regulations evolve and business operations change.

Customer Communication and Experience

Professional signage at business entrances and payment terminals provides clear, prominent notification of zero cost programs while maintaining attractive, professional appearance that reflects business quality and attention to customer service.

Staff training programs ensure team members can explain zero cost programs professionally and accurately while addressing customer questions and concerns with confidence and knowledge. Training includes scripts, frequently asked questions, and best practice recommendations.

Alternative payment method promotion educates customers about cash, debit, and other payment options that may provide cost savings while maintaining convenience and security. Balanced promotion supports customer choice while optimizing business operations.

Customer service best practices include empathetic communication, flexible problem-solving, and professional response to customer concerns about zero cost programs. Excellent customer service maintains relationships while implementing cost-saving measures.

Feedback collection systems enable ongoing program optimization based on customer input and business performance metrics. Regular feedback analysis supports continuous improvement and customer satisfaction enhancement.

Financial Impact and ROI Analysis

Processing fee elimination typically saves Phoenix businesses 2.5-4% of credit card transaction volume, resulting in annual savings of $2,000-10,000+ for most small businesses. Immediate cost reduction improves cash flow and profitability while supporting business growth and investment opportunities.

Cash flow improvement occurs immediately after zero cost program implementation, with monthly processing expenses eliminated or significantly reduced. Enhanced cash flow supports business operations, inventory investment, and growth initiatives throughout Phoenix.

Customer behavior analysis reveals payment method preferences and program acceptance rates, enabling optimization strategies that maximize cost savings while maintaining customer satisfaction. Data-driven insights support informed decision-making and program refinement.

Revenue impact assessment measures any changes in transaction volume, average ticket size, or customer retention resulting from zero cost program implementation. Most Phoenix businesses experience minimal negative impact while achieving substantial cost savings.

Long-term financial benefits compound over time as processing fee savings accumulate while business growth continues. Multi-year projections demonstrate significant return on investment and enhanced business sustainability through cost reduction.

Good Payments Merchant Services Zero Cost Advantage

Local Phoenix implementation services include on-site consultation, system configuration, staff training, and ongoing support specifically tailored to Valley business requirements and customer demographics. Personalized service ensures optimal program performance and customer satisfaction.

Comprehensive training programs cover all aspects of zero cost processing including compliance requirements, customer communication, and operational best practices. Ongoing education ensures staff confidence and program success while maintaining regulatory adherence.

Competitive program rates and transparent pricing eliminate hidden fees while maximizing cost savings for Phoenix businesses. Clear program terms and honest communication support informed decision-making and long-term business relationships.

Compliance monitoring services include regular program review, regulatory update notification, and adjustment recommendations to ensure continued compliance and optimal performance. Proactive compliance management protects businesses while maintaining cost savings.

Equipment maintenance and technical support programs ensure continued system operation and program performance while providing immediate assistance for technical issues or questions. Reliable support maintains business continuity and customer satisfaction.

Phoenix Market Considerations

Local consumer behavior analysis reveals Phoenix customers generally accept zero cost programs when properly explained and implemented with professional communication and transparent disclosure. Market research supports successful program implementation throughout the Valley.

Competitive landscape evaluation shows increasing zero cost program adoption among Phoenix businesses, making implementation a competitive necessity rather than advantage. Early adoption provides positioning benefits while maintaining customer expectations.

Tourism and visitor considerations include clear program explanation for out-of-state customers unfamiliar with zero cost processing. Professional communication and transparent disclosure ensure positive visitor experiences while maintaining cost savings.

Multi-location businesses throughout Phoenix can implement consistent zero cost programs across all locations while accommodating local market variations and customer preferences. Centralized management supports operational efficiency and compliance maintenance.

Seasonal business optimization addresses fluctuating transaction volumes and customer demographics throughout Arizona’s tourism cycles. Flexible program management accommodates business variations while maintaining cost savings and compliance.

Success Stories and Case Studies

Phoenix retail businesses report average annual savings of $3,000-8,000 through zero cost processing implementation with minimal customer complaints or transaction volume reduction. Professional implementation and staff training support successful program adoption and customer acceptance.

Restaurant operations throughout the Valley successfully implement zero cost programs for both counter service and table service with customer acceptance rates exceeding 95%. Proper signage, staff training, and customer communication ensure smooth program operation and maintained service quality.

Professional service businesses including law firms and medical practices achieve significant cost savings while maintaining client relationships through professional program presentation and transparent communication. Enhanced profitability supports business growth and service improvement.

Service industry businesses report improved cash flow and reduced operating expenses through zero cost processing while maintaining customer satisfaction and service quality. Mobile implementations enable field service cost savings without operational disruption.

Common Concerns and Solutions

Customer acceptance concerns are addressed through proper signage, staff training, and professional communication that emphasizes transparency and choice. Most Phoenix businesses experience high acceptance rates when programs are properly implemented and explained.

Competitive response strategies include emphasizing cost savings reinvestment in business improvements, customer service enhancement, and competitive pricing maintenance. Zero cost processing enables competitive positioning through improved profitability and operational efficiency.

Compliance maintenance requires ongoing attention to regulatory changes and program optimization, with Good Payments Merchant Services providing continuous monitoring and update services to ensure adherence to evolving requirements.

Technical support considerations include reliable system operation, prompt issue resolution, and ongoing maintenance to ensure continued program performance and customer satisfaction. Professional technical support maintains business continuity and program effectiveness.

Alternative payment integration promotes cash, debit, and other payment methods that provide customer choice while supporting business cost optimization. Balanced payment method promotion maintains customer satisfaction while maximizing cost savings.

Ready to eliminate credit card processing fees and boost your Phoenix business profitability with zero cost processing solutions? Contact Good Payments Merchant Services today for your complimentary cost analysis and discover how our compliant, customer-friendly zero cost programs can transform your payment processing from a business expense into a profit-neutral operation that supports sustainable growth.

Frequently Asked Questions

Q: Is zero cost credit card processing legal in Phoenix and Arizona?

A: Yes, zero cost processing programs are legal in Arizona when properly implemented with appropriate customer disclosure and compliance with state and federal regulations. Surcharge programs must include prominent signage, clear customer notification, and fee limitations as specified by law. Good Payments Merchant Services ensures all implementations meet legal requirements while maximizing cost savings for Phoenix businesses.

Q: How much can Phoenix businesses save with zero cost processing programs?

A: Most Phoenix businesses save 2.5-4% of their credit card transaction volume annually, typically resulting in $2,000-10,000+ in annual savings depending on transaction volume. For example, a business processing $100,000 annually in credit cards could save $3,000+ per year. Exact savings depend on current processing rates, transaction volume, and program type implemented.

Q: Will zero cost processing hurt my customer relationships or reduce sales?

A: When properly implemented with professional signage, staff training, and transparent communication, most Phoenix businesses experience minimal customer resistance. Studies show 90%+ customer acceptance rates for well-implemented programs. Many customers appreciate transparency and understand that businesses need to manage costs while continuing to provide quality products and services.

Q: What equipment changes are needed to implement zero cost processing?

A: Most modern POS systems can be configured for zero cost processing through software updates rather than equipment replacement. Systems need capability for automatic surcharge calculation, customer notification, and compliant transaction documentation. Good Payments Merchant Services evaluates existing equipment and recommends optimal configuration or minimal upgrades as needed.

Q: How quickly can zero cost processing be implemented for my Phoenix business?

A: Implementation typically takes 5-10 business days including equipment configuration, staff training, signage installation, and system testing. The process includes compliance review, staff education, and customer communication preparation to ensure smooth program launch. Good Payments Merchant Services coordinates implementation to minimize business disruption while ensuring proper program operation.

Q: Are there any businesses that shouldn’t use zero cost processing?

A: Zero cost processing works well for most Phoenix businesses, but may not be optimal for businesses with very low transaction volumes, high average tickets, or customer bases particularly sensitive to fees. Professional consultation evaluates business type, customer demographics, and transaction patterns to determine program suitability and recommend optimal approaches for cost savings.

Q: What ongoing support does Good Payments Merchant Services provide for zero cost programs?

A: We provide comprehensive ongoing support including compliance monitoring, regulatory update notifications, staff retraining as needed, technical support, and program optimization recommendations. Our Phoenix-based team offers personalized support for signage updates, customer communication improvements, and program adjustments based on business changes or regulatory requirements.