Stand-Alone Terminals

Secure, Reliable, and Flexible Payment Solutions for Every Business

At Good Payments Merchant Services, we understand that efficient and secure payment processing is essential to your business operations. That’s why we offer stand-alone terminals, a reliable, all-in-one solution for accepting payments without the need for a full POS system. Whether you operate a retail store, restaurant, or service-based business, our terminals deliver the speed, flexibility, and ease of use your team and customers expect.

Let's Get Started

Not sure where to start? Call us and our merchant services experts will guide you to the perfect solution that meets your needs.

What Are Stand-Alone Terminals?

Stand-alone terminals are self-contained payment processing devices that operate independently of a traditional point-of-sale system. These compact terminals allow you to accept credit cards, debit cards, and contactless payments—such as Apple Pay and Google Pay—with ease.

They’re a popular choice for small businesses, mobile operations, and any environment where quick, secure transactions are a priority. Our terminals are designed for plug-and-play convenience, making them ideal for countertop, mobile, or multi-location setups.

Functionality of Stand-Alone Terminals

At Good Payments Merchant Services, we understand that simplicity and reliability are key when it comes to payment processing. Stand-alone terminals are secure, dedicated devices designed to process transactions efficiently—without the need for integration into a larger POS system. These versatile terminals can accept credit cards, debit cards, EMV chip cards, and contactless payments like Apple Pay and Google Pay.

Whether you’re operating from a fixed location or on the move, stand-alone terminals offer the speed, flexibility, and convenience your business needs to meet evolving customer expectations. With customizable features and straightforward setup, they’re an essential tool for businesses seeking to deliver a seamless checkout experience.

Types of Stand-Alone Terminals

We offer a variety of stand-alone terminal options to suit the unique demands of your business. Each terminal type is designed to offer distinct advantages, whether you operate in-store, at events, or on the road:

|

Terminal Type |

Key Features |

|

Countertop Terminals |

Stable, wired or wireless setup, secure processing, ideal for retail & dining. |

|

Mobile Terminals |

Compact, lightweight, with wireless connectivity—perfect for payments on-the-go. |

|

Wireless Terminals |

Flexible placement, long battery life, and real-time transaction capability. |

|

Touchscreen Terminals |

Modern interface, easy navigation, fast and user-friendly payment experience. |

|

Signature Capture Terminals |

Enables secure digital signatures, reducing paper use and speeding up checkout. |

Each terminal can be tailored to your business’s specific needs. Whether you need portability, a sleek user interface, or high-volume durability, we’ll help you find the right fit.

Why Stand-Alone Terminals Work for Your Business

Choosing the right payment terminal is about more than just processing transactions—it’s about optimizing your workflow and enhancing your customer’s experience. Stand-alone terminals from Good Payments Merchant Services offer:

- Ease of Use: No complex POS integrations required. Staff can be trained quickly.

- Security: Equipped with EMV, encryption, and PCI-DSS compliance to safeguard transactions.

- Flexibility: Use them in-store, outdoors, or on-site at customer locations.

- Scalability: Add terminals as your business grows, with no downtime or system overhauls.

Let us help you choose the terminal solution that meets your goals and delivers a secure, efficient experience for both you and your customers.

Benefits of Stand-Alone Terminals

At Good Payments Merchant Services, we know that speed, simplicity, and security are crucial when it comes to processing payments. Our stand-alone terminals offer a powerful combination of flexibility, performance, and reliability—making them a smart solution for businesses of all sizes. Whether you’re running a retail store, a service-based business, or a pop-up event, our terminals are designed to streamline transactions and support your success.

Why Businesses Choose Our Stand-Alone Terminals

- Faster Transactions: Process payments up to 50% faster compared to traditional methods, allowing you to serve more customers and reduce wait times.

- Enhanced Customer Experience: Provide a quick, seamless checkout that builds trust and encourages repeat visits.

- Scalable for Any Size: Whether you’re a growing startup or an established enterprise, our terminals can be tailored to meet your operational needs.

Ease of Use & Quick Setup

Getting started with a stand-alone terminal is simple. Our plug-and-play devices are built for ease of use—no complicated tech skills required. We’ll walk you through the setup, and our dedicated support team is always just a call away to answer any questions.

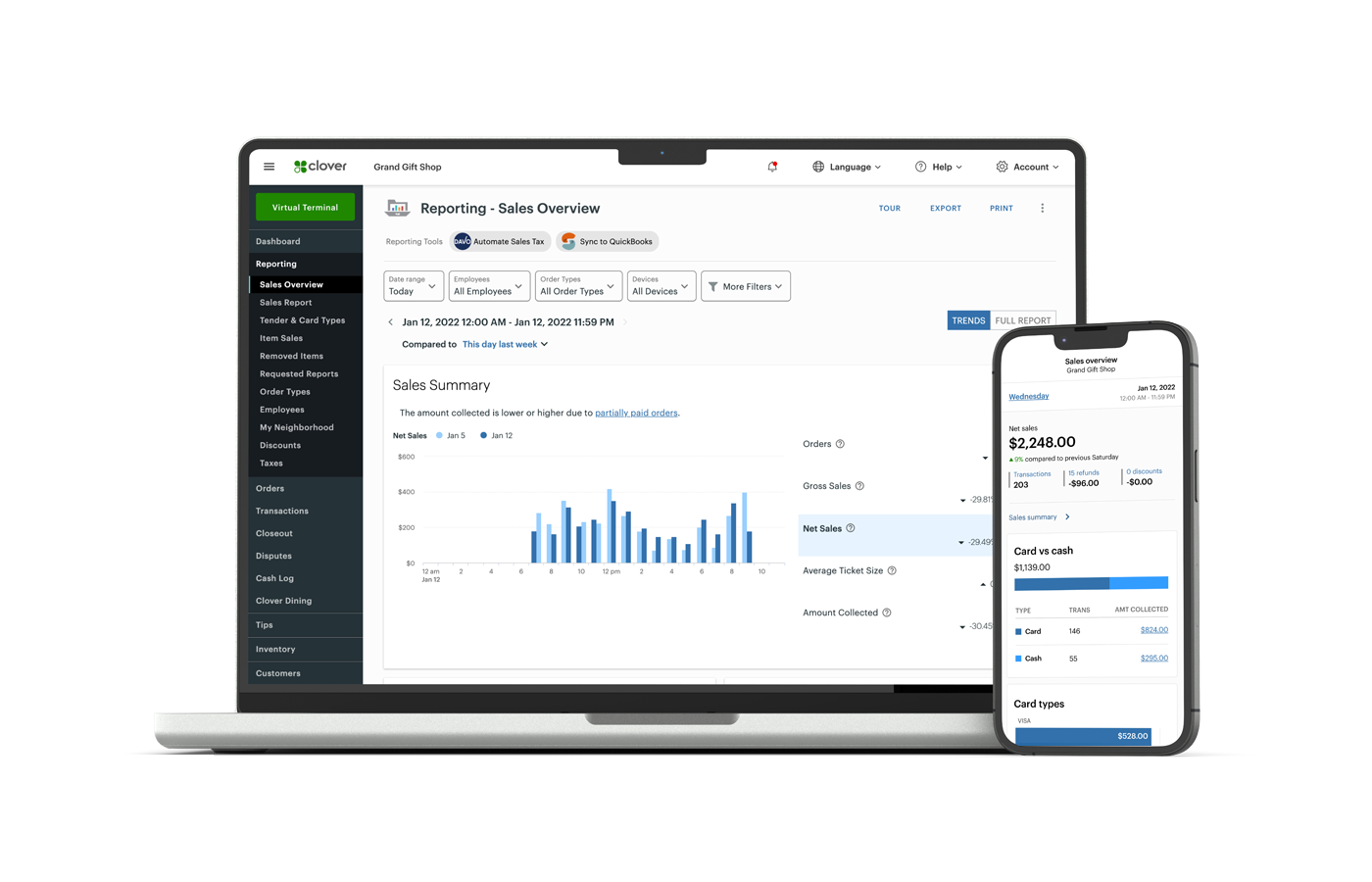

With intuitive interfaces and real-time sales tracking, you’ll spend less time managing payment systems and more time focusing on your business. We also provide onboarding assistance, training resources, and ongoing support to ensure your team is confident from day one.

Advanced Security You Can Trust

Security is a top priority at Good Payments Merchant Services. Our stand-alone terminals feature end-to-end encryption, EMV compliance, and tokenization technology to protect every transaction. With built-in fraud prevention and PCI-DSS certified systems, you and your customers can rest assured that sensitive information stays protected.

Businesses using secure payment terminals report up to 70% fewer data breach risks—a vital advantage in today’s digital landscape. With our technology, you’re not just meeting compliance standards; you’re exceeding them.

Future-Ready and Scalable

As your business grows, your payment needs evolve. Our stand-alone terminals can adapt with you—supporting multiple payment types including contactless cards, mobile wallets, and traditional chip & PIN. Whether you’re managing one location or expanding to several, we offer scalable solutions that grow with your operations.

Choose Good Payments Merchant Services for secure, efficient, and user-friendly stand-alone terminals. Let’s help you simplify transactions, delight your customers, and drive your business forward.

How to Choose the Right Stand-Alone Terminal

Choosing the right stand-alone payment terminal is a critical step toward enhancing your business operations and delivering a seamless customer experience. With so many options available, it’s important to select a terminal that aligns with your specific business needs—whether you’re managing a high-volume retail store, a mobile service, or a small boutique.

At Good Payments Merchant Services, we help you cut through the noise and focus on what matters most: security, speed, and flexibility. From transaction volume to connectivity options, the right terminal should be built to scale with your operations and support your long-term goals.

Key Features to Consider

When selecting a stand-alone terminal, prioritize features that support your workflow and customer experience. Here are essential factors to evaluate:

- Multi-Payment Capability: Accept credit, debit, EMV chip, contactless, and mobile wallet payments like Apple Pay® and Google Pay®.

- Enhanced Security: Look for PCI-DSS compliance, point-to-point encryption (P2PE), and tokenization to safeguard sensitive data.

- Flexible Connectivity: Choose from Wi-Fi, Ethernet, or 4G/LTE options depending on where and how you do business.

- User-Friendly Interface: A clear, intuitive design ensures smooth transactions for your staff and customers.

- System Compatibility: Ensure seamless integration with your POS software, inventory tools, or business management systems.

- Scalability: Select a solution that grows with your business—adding features, locations, or devices as needed.

Understand Your Business Requirements

Before committing to a terminal, take a comprehensive look at your business operations:

- Transaction Volume: High-traffic locations may require faster processing speeds and multi-device support.

- Mobility Needs: If your team works on the go, mobile and wireless terminals with long battery life are essential.

- Customer Preferences: Are your customers requesting tap-to-pay options or digital receipts? Choose a terminal that supports evolving expectations.

- Industry Demands: Restaurants may need tip adjustment features, while service providers may prioritize printed receipts and quick refunds.

At Good Payments Merchant Services, we help you assess your specific use case and recommend a stand-alone terminal that fits your operations—enhancing your efficiency, reducing downtime, and improving the payment experience.

Need help finding the best terminal for your business? Our team is here to guide you through every step—ensuring you get a secure, future-ready solution tailored to your goals.

Why Choose Good Payments Merchant Services for Stand-Alone Terminals?

Whether you’re launching a new business or upgrading your existing payment system, having a secure, reliable, and efficient solution is crucial. At Good Payments Merchant Services, our stand-alone terminals are built to help you process payments effortlessly, reduce errors, and provide a smooth experience for your customers—every time.

From accepting chip, swipe, and contactless payments to accessing real-time reporting, our robust terminal solutions support your daily operations and long-term goals. We serve businesses of all sizes with customizable tools that increase productivity, streamline workflows, and drive growth.

Competitive Pricing & Flexible Plans

We provide cost-effective payment solutions designed to scale with your business. Choose from flat-rate, tiered, or custom pricing based on your transaction volume and business needs.

- Accept payments in-person, online, or by phone

- Easily adapt plans as your business grows

- Lower payment processing costs by up to 18%

- Improve customer retention and reduce churn

Exceptional Customer Support, 24/7

Our U.S.-based support team is available around the clock to assist you with onboarding, troubleshooting, and system optimization. Whether you’re a first-time user or an experienced business owner, we make sure you’re never left in the dark.

- Real-time support and training

- Proactive account monitoring

- 24/7 access to experienced professionals

Merchants report a 15% increase in customer satisfaction and a 20% drop in payment errors thanks to our dependable service.

Seamless Integration & User-Friendly Design

Our stand-alone terminals are plug-and-play ready with intuitive interfaces that require minimal training. Whether you’re processing payments at the front counter or on the go, setup is quick and easy no technical background required.

- Simple setup in minutes

- Compatible with most POS systems and software

- Touchscreen and signature capture options available

- Supports contactless and mobile wallet payments

This ease of use results in quicker staff training, fewer transaction delays, and a better overall customer experience.

Secure, Compliant Transactions

Security is our priority. All Good Payments Merchant Services terminals come with end-to-end encryption, tokenization, and are PCI-DSS compliant, ensuring every transaction is processed securely and in full regulatory compliance.

- Protects customer data and reduces fraud risk

- Meets industry-leading security standards

- Reduces likelihood of breaches by up to 70%

Experience the Good Payments Advantage

Choosing Good Payments Merchant Services means partnering with a team that puts your business first. Our stand-alone terminals are designed to enhance every step of the payment process, backed by expert support, competitive pricing, and reliable performance.

Let us help you simplify your payments and grow with confidence.

Get started today with a solution tailored to your business needs.

Frequently Asked Questions(FAQs)

Q: What are Stand Alone Terminals and how do they work?

A: Stand Alone Terminals are electronic payment processing devices that allow businesses to accept credit and debit card payments independently. They work by connecting to a phone line or internet connection, enabling merchants to process transactions securely and efficiently. Our Stand Alone Terminals at Good Payments Merchant Services are designed to be user-friendly, reliable, and compatible with various payment types, including contactless and mobile payments.

Q: What are the benefits of using Stand Alone Terminals for my business?

A: Using Stand Alone Terminals can significantly enhance your business operations by increasing payment processing speed, reducing errors, and providing a seamless customer experience. With our terminals, you can accept a wide range of payment methods, including major credit and debit cards, and manage your transactions efficiently. Additionally, our terminals are equipped with advanced security features to protect your business and customers from potential fraud and data breaches.

Q: How do I choose the right Stand Alone Terminal for my business needs?

A: Choosing the right Stand Alone Terminal depends on several factors, including your business type, transaction volume, and payment processing requirements. At Good Payments Merchant Services, we offer a variety of terminals to suit different business needs. Our experienced team can help you assess your requirements and recommend the most suitable terminal for your business, ensuring that you can process payments efficiently and securely.

Q: Are Stand Alone Terminals secure and compliant with industry standards?

A: Yes, our Stand Alone Terminals are designed to meet the highest security standards, including PCI-DSS and EMV compliance. We prioritize the security of your business and customers, and our terminals are equipped with advanced features such as encryption, tokenization, and secure authentication. Our team ensures that our terminals are regularly updated and maintained to prevent any potential security vulnerabilities, giving you peace of mind when processing payments.

Q: Why should I choose Good Payments Merchant Services for my Stand Alone Terminal needs?

A: At Good Payments Merchant Services, we pride ourselves on providing exceptional customer service, competitive pricing, and tailored solutions to meet the unique needs of your business. Our team is dedicated to helping you navigate the payment processing landscape, ensuring that you can focus on growing your business. By choosing us, you can benefit from our expertise, reliability, and commitment to delivering secure and efficient payment processing solutions, making us the ideal partner for your business.

Solutions For All Types Of Payments

Contact Info

Location

1776 N Scottsdale Road #8252

Scottsdale, Arizona 85252

Phone

Flexible Payment Solutions to Power Your Business

Whether you’re at the counter, on the go, or selling online, we provide the right tools to accept payments with ease. Discover a full suite of POS systems and processing solutions built to grow with you.

Clover Family

CardPointe Suite

Wireless & Mobile

Our wireless and mobile POS systems are designed for businesses on the move. Equipped for WiFi and 5G connectivity, these devices accept a full range of payments including credit, debit, EBT, gift cards, and checks. The “store-and-forward” feature ensures transactions are saved even when there’s no signal—giving you peace of mind wherever business takes you. It’s perfect for food trucks, service providers, and vendors who need flexibility without sacrificing reliability.

Stand Alone Terminals

Our stand-alone terminals offer a straightforward, dependable way to accept payments without the need for a full POS system. Designed for businesses that want simplicity, these terminals support a wide range of payment types including chip cards, contactless payments, and more. With options for wireless or ethernet connectivity and easy integration into your existing setup, our terminals provide secure, fast, and efficient transaction processing for any business environment.

E-Commerce & Virtual Terminals

Expand your reach and take payments online with our e-commerce and virtual terminal solutions. Whether you run a full online store or need a way to invoice customers remotely, we provide secure tools to process credit card transactions over the web. Our virtual terminals allow you to key in payments from any device with internet access, offering flexibility and efficiency without needing physical hardware. It’s ideal for service-based businesses, remote teams, and digital retailers.

Zero Cost Processing

Our Zero Cost Processing program helps businesses save money by offsetting credit card processing fees through legal and compliant methods. Using either a Cash Discount or Surcharge Program, you can build the cost of processing into your pricing or pass a small fee directly to customers who choose to pay with cards. This innovative approach reduces your overhead while maintaining transparency with customers—and it’s fully compliant with current regulations.

Agent and ISO Program

If you’re a sales agent or ISO in the merchant services industry, our Agent and ISO Program is built to help you succeed. We offer the support, tools, and resources you need to close deals faster, retain more clients, and scale your business. With competitive payouts, real-time reporting, marketing materials, and access to industry-leading payment solutions, you and your merchants become part of a team committed to shared success. Join us and start growing today.

Stand Alone Terminals Phoenix: Your Complete Guide to Best Merchant Services Phoenix for Independent Payment Processing Solutions

When Phoenix businesses search for “Virtual Terminal near me,” they often discover that stand alone terminals provide the perfect complement to virtual payment processing solutions. Virtual Terminal Phoenix capabilities combined with dedicated stand alone payment terminals create a comprehensive payment ecosystem that serves diverse business needs throughout the Valley. Good Payments Merchant Services specializes in both virtual terminal solutions and physical stand alone terminals, delivering small business payment solutions near me that scale from single-location operations to multi-site enterprises. As one of the best merchant services Phoenix providers, we understand that modern businesses require flexible payment acceptance options, whether processing phone orders through virtual terminals or handling in-person transactions with dedicated stand alone terminal hardware.

Key Takeaways

- Independent Processing Power: Stand alone terminals operate independently without requiring complex POS integration, providing reliable payment processing that maintains functionality even when other business systems experience issues

- Cost-Effective Solution: Dedicated terminals often cost significantly less than full POS systems while delivering essential payment processing capabilities perfect for Phoenix small businesses and service providers

- Enhanced Security Standards: Stand alone terminals meet the highest PCI compliance requirements with built-in encryption, EMV chip processing, and secure authentication protocols

- Virtual Terminal Integration: Browser-based virtual terminals complement physical hardware, enabling Phoenix businesses to process phone orders, recurring payments, and remote transactions seamlessly

- Flexible Connectivity Options: Ethernet, Wi-Fi, and cellular connectivity ensure reliable payment processing throughout Phoenix, with backup options maintaining service during network disruptions

- Industry Versatility: From retail counters to healthcare offices, stand alone terminals adapt to any Phoenix business environment with customizable features and processing capabilities

- Local Phoenix Support: Good Payments Merchant Services provides on-site installation, training, and ongoing maintenance with personalized service that national processors cannot match

Understanding Stand Alone Terminal Solutions

Stand alone terminals represent the foundation of reliable payment processing for Phoenix businesses seeking dedicated, independent transaction capabilities. Unlike integrated POS systems that combine multiple business functions, stand alone terminals focus exclusively on secure payment acceptance with proven reliability and straightforward operation that minimizes training requirements and operational complexity.

These dedicated payment devices operate independently of other business systems, ensuring continued payment acceptance even when computers, networks, or software applications experience problems. Phoenix businesses appreciate this reliability during peak operating periods when system stability becomes critical for maintaining customer service and revenue flow.

Stand alone terminals excel in environments where simplicity and reliability take priority over advanced features. Many Phoenix businesses discover that dedicated terminals provide exactly the payment processing capabilities they need without unnecessary complexity or expense associated with comprehensive POS implementations.

The distinction between virtual terminals and physical stand alone terminals creates complementary capabilities for modern Phoenix businesses. Virtual terminals enable remote payment processing through web browsers, while physical terminals handle in-person transactions with card readers, PIN pads, and receipt printers integrated into dedicated hardware.

Comprehensive Stand Alone Terminal Portfolio

Countertop Payment Terminals serve as the workhorse solution for Phoenix businesses requiring reliable, high-volume payment processing at fixed locations. These robust terminals feature large displays, integrated printers, and comprehensive connectivity options that support busy retail environments, restaurants, and service businesses throughout the Valley.

Wireless Stand Alone Terminals provide portable payment processing freedom without sacrificing the independence and reliability of dedicated terminal hardware. Phoenix businesses use these solutions for tableside service, mobile checkout stations, and temporary payment acceptance locations while maintaining secure, encrypted transaction processing.

Pin Pad Terminals focus specifically on secure PIN entry and chip card processing for businesses requiring enhanced debit card acceptance and security compliance. These specialized terminals integrate with existing systems or operate independently while ensuring maximum security for PIN-based transactions throughout Phoenix.

Check Reader Terminals enable electronic check conversion and processing for Phoenix businesses accepting paper checks. These terminals scan, verify, and convert checks into electronic transactions while providing immediate authorization and reducing the risks associated with traditional check acceptance.

Multi-Function Terminals combine payment processing with additional business capabilities including inventory lookup, employee time tracking, and basic reporting functions. Phoenix businesses benefit from consolidated functionality while maintaining the simplicity and reliability of stand alone terminal operation.

Virtual Terminal Integration & Capabilities

Browser-based payment processing through virtual terminals enables Phoenix businesses to accept payments from any computer or mobile device with internet access. This flexibility proves essential for businesses processing phone orders, handling recurring billing, or managing remote payment collection without requiring dedicated hardware at every location.

Remote transaction management capabilities allow Phoenix business owners and staff to process payments, issue refunds, and manage customer accounts from any location within the Valley or beyond. Virtual terminals provide the same security and functionality as physical terminals while offering enhanced accessibility and operational flexibility.

Phone order and mail order processing becomes streamlined through virtual terminal interfaces that guide users through secure transaction entry while maintaining PCI compliance standards. Phoenix businesses can efficiently process customer payments received through multiple channels while ensuring consistent security and record-keeping.

Recurring billing and subscription management features automate regular payment collection for Phoenix service providers, health clubs, professional practices, and subscription-based businesses. Virtual terminals handle scheduling, processing, and customer communication while reducing administrative overhead and improving cash flow predictability.

Multi-user access controls enable Phoenix businesses to provide payment processing capabilities to multiple employees while maintaining security and accountability through individual login credentials and permission levels. Managers can monitor activity and maintain oversight while distributing payment processing responsibilities throughout their organization.

Stand Alone Terminal Features & Functionality

EMV chip card processing compliance ensures Phoenix businesses meet current payment security standards while protecting against fraud liability shifts. Stand alone terminals support chip-and-PIN, chip-and-signature, and contactless chip transactions with fast processing speeds that maintain customer satisfaction during busy periods.

Contactless payment acceptance through NFC technology enables Phoenix customers to use Apple Pay, Google Pay, Samsung Pay, and contactless credit cards for convenient, secure transactions. Modern stand alone terminals integrate contactless capabilities seamlessly with traditional payment methods.

Magnetic stripe card compatibility maintains support for older cards and international visitors who may not have chip-enabled cards. Phoenix businesses can accommodate all customer payment preferences while maintaining security standards and processing efficiency.

Receipt printing capabilities provide immediate transaction confirmation with customizable headers and footers that include business information, promotional messages, and customer service details. Phoenix businesses can enhance customer communication while maintaining professional transaction documentation.

Real-time transaction authorization and settlement ensure immediate payment confirmation with next-day funding for most transactions. Phoenix businesses benefit from fast payment processing that improves cash flow while providing instant feedback on transaction approval or decline status.

Industry-Specific Terminal Applications

Retail Businesses throughout Phoenix rely on stand alone terminals for quick, efficient checkout processes that handle high transaction volumes during peak periods. These terminals integrate with existing operations while providing the reliability and speed necessary for maintaining customer satisfaction and operational efficiency.

Restaurants & Food Service establishments use stand alone terminals for counter service, drive-through operations, and tableside payment processing. Phoenix dining businesses appreciate the reliability and simplicity of dedicated terminals that continue operating even when restaurant management systems experience issues.

Professional Services including legal offices, accounting firms, and consulting practices throughout Phoenix use stand alone terminals for client payment collection and retainer processing. These terminals provide professional payment acceptance while maintaining the security and compliance standards required for sensitive client relationships.

Healthcare Practices rely on stand alone terminals for patient copay collection, outstanding balance payments, and insurance deductible processing. Phoenix medical offices benefit from HIPAA-compliant payment processing that integrates with patient management workflows while maintaining privacy and security standards.

Service Industries including automotive repair, home improvement, and personal services throughout Phoenix use stand alone terminals for on-site payment collection and invoice processing. These terminals enable immediate payment acceptance while maintaining professional transaction processing capabilities.

Good Payments Merchant Services Terminal Advantage

As a locally-owned Phoenix merchant services provider, Good Payments Merchant Services understands the unique challenges facing Valley businesses implementing stand alone terminal solutions. Our team provides personalized consultation to identify optimal terminal configurations based on transaction volumes, business types, and operational requirements specific to Phoenix market conditions.

Local installation and configuration services ensure smooth terminal implementation with minimal business disruption. Our Phoenix technicians handle equipment delivery, network setup, and system configuration while providing comprehensive training that ensures staff confidence and operational efficiency from day one.

Competitive terminal leasing and purchase options provide flexible financing alternatives that accommodate various budget requirements and business preferences. Phoenix businesses can choose from rental, lease-to-own, or outright purchase arrangements with transparent pricing that eliminates hidden fees and surprise charges.

Comprehensive training programs cover all aspects of terminal operation, from basic transaction processing to advanced features and troubleshooting procedures. Good Payments Merchant Services ensures Phoenix business staff feel confident using their terminals while providing ongoing educational resources for continued learning.

Equipment maintenance and replacement programs protect Phoenix businesses from unexpected terminal failures with comprehensive coverage that includes repair services, loaner equipment, and replacement terminals when necessary. Our proactive approach minimizes downtime while maintaining consistent payment processing capabilities.

Payment Processing Types & Acceptance

Credit card processing through stand alone terminals supports all major card brands including Visa, MasterCard, Discover, and American Express with competitive interchange rates and fast authorization times. Phoenix businesses can accept the full range of customer payment preferences while maintaining cost-effective processing expenses.

Debit card and PIN-based transaction processing provides secure payment acceptance with lower processing costs for businesses and convenient payment options for customers. Stand alone terminals support both signature and PIN debit transactions while maintaining the highest security standards.

Gift card and stored value program support enables Phoenix businesses to implement customer loyalty programs and gift card sales through their existing terminal infrastructure. These programs increase customer retention while providing additional revenue opportunities and marketing advantages.

Fleet card and corporate card acceptance accommodates business customers throughout Phoenix who use specialized payment cards for expense management and reporting purposes. Stand alone terminals process these transactions with appropriate data capture for business accounting and reporting requirements.

International card processing capabilities enable Phoenix businesses to accept payments from tourists and international visitors using foreign-issued credit and debit cards. Terminals support multiple currencies and international card standards while maintaining security and compliance requirements.

Security & Compliance Standards

PCI DSS compliance certification ensures Phoenix businesses meet the highest payment security standards while receiving ongoing support for maintaining certification requirements. Good Payments Merchant Services provides guidance and monitoring to ensure continued compliance without overwhelming administrative burden.

End-to-end encryption protects sensitive payment data throughout the entire transaction process, from initial card interaction through final settlement and reporting. Phoenix businesses can assure customers that their payment information remains secure while meeting industry security requirements.

Secure key management and authentication protocols protect terminal access and transaction processing through advanced security measures that prevent unauthorized use or data compromise. Regular security updates ensure terminals maintain protection against evolving threats and vulnerabilities.

Fraud prevention and risk management tools analyze transaction patterns and customer behavior to identify potentially fraudulent activity before it impacts Phoenix businesses. Real-time monitoring and alerts enable quick response to suspicious transactions while minimizing false positives that could inconvenience legitimate customers.

Terminal Setup & Configuration Options

Network connectivity requirements vary based on business location and infrastructure, with options including ethernet, Wi-Fi, and cellular connectivity to ensure reliable payment processing throughout Phoenix. Good Payments Merchant Services evaluates connectivity options during installation to recommend optimal configurations for each business environment.

Paper roll and supply management includes ongoing provision of receipt paper, cleaning supplies, and other consumables necessary for terminal operation. Phoenix businesses can focus on their core operations while ensuring their payment processing equipment remains properly maintained and operational.

Custom receipt header and footer programming enables Phoenix businesses to include logos, promotional messages, contact information, and other customized content on customer receipts. This capability enhances brand recognition while providing additional marketing opportunities at the point of sale.

Terminal parameter configuration optimizes processing settings based on business type, transaction patterns, and operational requirements. Good Payments Merchant Services configures terminals for optimal performance while providing flexibility for future adjustments as business needs evolve.

Cost Analysis & Pricing Structure

Terminal equipment costs vary based on features, connectivity requirements, and processing volumes, with flexible financing options that accommodate diverse budget requirements. Good Payments Merchant Services provides transparent pricing analysis that includes equipment costs, processing fees, and ongoing service charges for accurate budget planning.

Processing rate optimization ensures Phoenix businesses receive competitive interchange rates based on their specific transaction patterns and business characteristics. We analyze existing processing costs and recommend terminal solutions that often provide immediate cost savings compared to current arrangements.

Monthly service fees and transaction charges are clearly outlined with no hidden costs or surprise fees that could impact business profitability. Phoenix businesses receive detailed fee schedules and can accurately predict payment processing expenses for effective financial planning.

Return on investment calculations demonstrate how stand alone terminals often provide superior value compared to more complex POS systems for businesses requiring basic payment processing capabilities. Many Phoenix businesses discover that dedicated terminals offer better cost-effectiveness while meeting their essential payment acceptance needs.

Phoenix Business Success Stories

Local Phoenix retail businesses have streamlined checkout processes and reduced transaction times using dedicated stand alone terminals that handle high-volume periods reliably. One popular Scottsdale boutique reduced average checkout time by 30% while eliminating system crashes that previously disrupted sales during busy periods.

Healthcare practices throughout Phoenix have improved patient payment collection and reduced administrative overhead using stand alone terminals configured for medical office workflows. A multi-location practice reported 50% faster copay collection and significantly improved patient satisfaction with convenient payment options.

Restaurant operations across Phoenix have enhanced customer service and reduced wait times using wireless stand alone terminals for tableside payment processing. Dining establishments report improved table turnover rates and customer satisfaction while maintaining reliable payment processing during peak service periods.

Phoenix service businesses have accelerated payment collection and improved cash flow using portable stand alone terminals for on-site customer payments. Contractors and service providers report immediate payment collection rates exceeding 90% compared to invoice-based billing that often resulted in delayed payments.

Ready to streamline your Phoenix business payment processing with reliable stand alone terminal solutions? Contact Good Payments Merchant Services today for your complimentary terminal consultation and discover why we’re recognized as the best merchant services Phoenix provider for independent payment processing solutions that grow with your business.

Frequently Asked Questions

Q: What’s the difference between stand alone terminals and integrated POS systems for Phoenix businesses?

A: Stand alone terminals focus exclusively on payment processing with dedicated hardware that operates independently of other business systems. They’re typically less expensive, easier to use, and more reliable than integrated POS systems, but offer fewer business management features. Phoenix businesses often choose stand alone terminals when they need reliable payment processing without the complexity and cost of full POS implementations.

Q: How much do stand alone terminals cost for Phoenix businesses?

A: Terminal costs vary based on features and connectivity requirements, typically ranging from $200-800 for purchase or $15-50 monthly for leasing arrangements. Processing fees depend on transaction volume and business type, but Good Payments Merchant Services offers competitive rates with transparent pricing. Many Phoenix businesses find stand alone terminals provide better value than complex POS systems for basic payment processing needs.

Q: Can stand alone terminals accept contactless payments and mobile wallets?

A: Yes, modern stand alone terminals support contactless payments including Apple Pay, Google Pay, Samsung Pay, and tap-to-pay credit cards through built-in NFC technology. These terminals also process traditional chip cards, magnetic stripe cards, and PIN debit transactions, providing comprehensive payment acceptance for Phoenix businesses and their customers.

Q: How reliable are stand alone terminals compared to other payment processing options?

A: Stand alone terminals are typically more reliable than integrated systems because they operate independently without depending on computers, software, or network connections to other business systems. Phoenix businesses appreciate this reliability during peak periods or when other systems experience issues. Most terminals include backup connectivity options and can store transactions offline if necessary.

Q: What kind of support does Good Payments Merchant Services provide for stand alone terminals?

A: We provide comprehensive local Phoenix support including on-site installation, staff training, 24/7 technical assistance, and equipment replacement programs. Our Phoenix-based team responds quickly to service needs and provides personalized support that national processors cannot match. We also handle maintenance, updates, and compliance monitoring to keep terminals operating optimally.

Q: How quickly can Good Payments Merchant Services install stand alone terminals for my Phoenix business?

A: Most stand alone terminal installations are completed within 2-3 business days from approval, including equipment delivery, setup, and staff training. Simple counter terminals can often be installed and activated within 24-48 hours, while wireless or multi-terminal installations may require additional time for network configuration and testing.

Q: Do stand alone terminals require special internet connections or phone lines?

A: Modern stand alone terminals typically connect through ethernet, Wi-Fi, or cellular networks without requiring dedicated phone lines. Good Payments Merchant Services evaluates your Phoenix business location during installation to recommend the best connectivity option based on reliability, cost, and performance requirements. Most businesses can use existing internet connections for terminal connectivity.